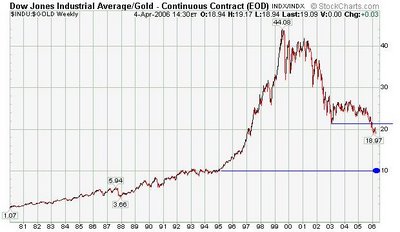

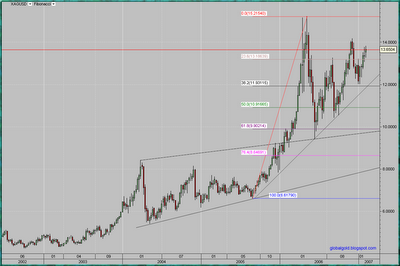

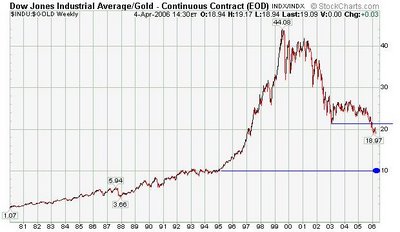

Dow Jones / Gold, Gold / Oil & Gold / Silver ratios are some of the most Interesting and informative pieces of data, here is why:

When we compare the Price of gold to the price of the two other commodities or the old Dow Jones index the value of the dollar becomes a non issue. It is a simple math exercise, when we look at the price of the Dow , Silver & Oil, we actually look at:

Dow (1 index unit) / USD(1 ? unit ), Silver(1 oz unit) / USD (1 ? unit) & Oil (1 Barrel unit) / USD (1 ? unit).

So if we divide Dow with Gold , Gold with Silver or Oil we can simply ignore the denominator (the USD in this case) according to simple algebra (fraction division law), here is an example :

(A/B)/(C/D) = (A/B)*(D/C) = AD/BC

Likewise:

[Dow (1 index unit) / USD (1 ? unit)] / [Gold(1 oz unit) / USD (1 ? unit)] =

[Dow (1 index unit) / USD (1 ? unit)] * [USD (1 ? unit) / Gold(1 oz unit)] =

[Dow (1 index unit) * USD (1 ? unit)] / [USD (1 ? unit) * Gold(1 oz unit)] =

Dow (1 index unit) / Gold(1 oz unit) =>

This ratio is not directly dependent on the USD (or any other currency)

As you notice each of the objects is measured by a constant measurement unit: Gold and Silver are measured in troy ounce or other weight unit , crude oil is usually measured in barrels or other volume unit, The Dow Jones is measured with index unit. Currencies like the US dollar also pretend to be a basic measure unit , but unlike troy ounce, barrel or any other physical measurement unit currencies are non constant and not stable.