There are 3 main gold stocks( gold and sometimes silver mining companies) Indices: CBOE GOLD INDEX(

GOX) , AMEX GOLD BUGS INDEX

(HUI) and the most known PHLX GOLD AND SILVER SECTOR IND (

XAU).

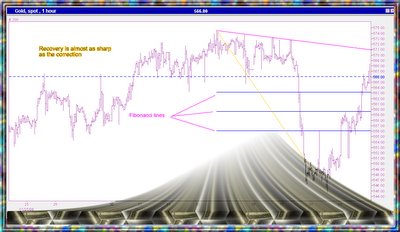

The fact that the gold stock indices had very small correction is a positive sign for the near future price of gold ( the gold indices tend to lead the gold price most of the time).

Not much have changed today with the price of gold but gold indices moved higher.

Please note that gold & silver stocks are very different from the metals for a wide range of reasons : production cost , declining reserves, politics , hedging, human factor – to name a few... , However it’s interesting to follow their performance for general market sentiment.