After reviewing the BIS OTC derivative report It is clear that gold and other commodities ( oil and maybe silver ) are still very important to the global monetary system , It’s very difficult to understand the report for several reasons :

1) The definitions are very general to say the least.

2) The data regarding Commodity contracts ( Gold & other) as well as E. “Other” (defined as : “ Include foreign exchange. Interest rate, equity and commodity derivatives of non reporting institutions, based on the triennial central bank survey on foreign exchange and derivative market activity”) is minimal.

3) Very little transparency.

However my insights are as follows:

1) The OTC derivatives market is huge and growing and might be accelerating! , Grant total notional amounts was 270.1 trillion US$ with Interest rate swaps contracts responsible for the majority (163.749 trillion $). Those numbers are very big compared to any other economic number on earth!

2) The grand total gross market value is much smaller at 10.694 Trillion, tough more volatile and could change quickly!

3) Total commodity contracts value is growing. Standing at 1.693 trillion for notional value and 271 billion for gross value. – note those are huge numbers but are representing just a few percents of the Grand Total for OTC derivatives.

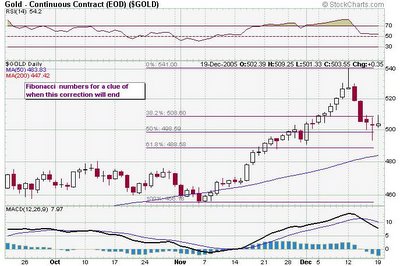

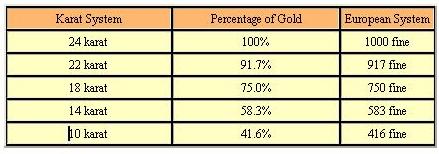

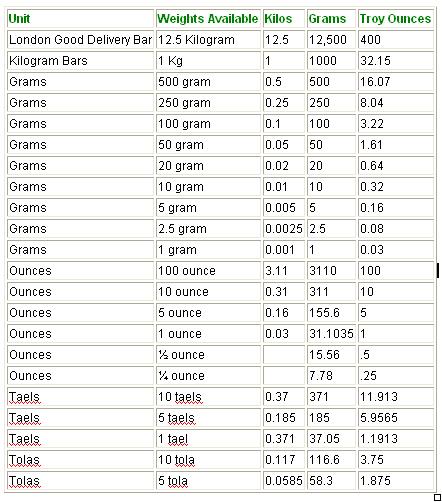

4) Gold contracts, both notional and gross values declined standing at 288 Billion US$ and 24 Billion US$ respectively. Nevertheless those are big numbers representing 693 million gold ounces for notional value and 57 million ounces for gross value. (Calculations based on a 415 $ / OZ at the end of June 05 ). A fairly big number considering total gold world wide production is just 82.5 million ounces annually.

5) Other commodities notional & gross values increased substantially. – We don’t really know what kinds of commodities are included but I guess they include oil and silver.

6) E.other standing at 27.793 trillion and 1.866 trillion for notional and gross values respectively. – the point is (and that’s a big point !) we cant know how many gold & commodities are hiding inside this numbers.

7)

The data is super non transparent , but one could feel lucky to have any data at all. The fact is that Gold and other commodities continue to be very important for the global monetary system and one should not rule out a renewed gold standard or something similar , It will be Interesting to see how higher (possibly much higher!) gold price affect the BIS report and the financial health of those holding a short gold position.

Please review the latest BIS OTC derivatives review - (pay special attention for sections D & E of table 1 on page 10.)yours + real1