Tuesday, December 25, 2007

Gold OTC derivatives

Gold OTC derivatives are actually down from 0.640 trillion to 0.426 trillion for notional amounts outstanding (-33.4%) and from 56 billion to 47 billion at gross market values (-16%).

Gold OTC derivatives are still just a tiny part of total OTC derivatives (less then 0.1% for notional value and a~0.42% at gross market values)

The decline of gold OTC derivatives is probably a direct result of:

1) De-Hedging by gold producers.

2) Market participants move their business from OTC derivatives into more liquid, transparent and regulated markets such as COMEX (GC) and CBOT (ZG).

You can see the BIS OTC derivatives report here

Friday, June 15, 2007

Switzerland gold sell ?!

The sell if they will isn't as meaningful as the reporter wants you to believe. Consider that the outstanding notional amount of gold over the counter derivatives is 463 billion USD , reported by the BIS December 2006.

Switzerland's central bank is to sell a further 250 tonnes of gold, dashing hopes for a revival in depressed bullion prices after months of heavy selling by Spain and Belgium.

The Swiss National Bank is world's fourth biggest holder of gold after the European Central Bank system, the United States, and the IMF. Most analysts thought it had stopped selling its horde after a 1,300 tonne "purge" between 2000 and 2004,

The SNB said yesterday it would feed a fifth of its remaining gold onto the market gradually between now and September 2009 as part of a rejigging strategy for its reserves.

sourceCOMEX gold contract for December 2009 is currently priced at about 750$

Monday, August 21, 2006

Gold Market Overview

Two reports, the first is by the World Gold Council (WGC) and GFMS, published each quarter.

Gold supply demand analysis report I

The second report, the Yellow Book by Virtual metals / Fortis bank, published twice a year.

Gold supply demand analysis report II

The reports are worth reading and basically present the same information. However, each rely on different data and the numbers are not quite the same. In my opinion the data is not so accurate to say the least. It is impossible to track the complete supply demand of gold, some kind of gold transactions are taking place in each and every country and some markets are not very transparent.

Read this reports with a grain of salt , this is as good as it gets but take in to account that all analysts and entities have their own agenda , market sentiment , position and so forth.

Gold miners hedging

The Hedge Book by Mitsui Global Precious Metals, Virtual Metals and Haliburton Mineral Services – This report analyze the hedging practice (forward gold transactions) of the gold miners industry - I assume that this report is relatively accurate when compared with the supply demand reports. This report is tracking the gold mining industry and most of the hedge practice is concentrated with few big miners.

Gold miners hedging report

Gold over the counter derivatives report by the Bank for International Settlements (BIS)

The Semiannual Over-The-Counter (OTC) Derivatives Markets Statistics is comprehensive and provide some information on the size and structure of derivatives markets in the G10 countries and Switzerland. Gold OTC Derivatives are just a small fraction of total OTC derivatives, gold derivatives represents less then 1% of total Over-The-Counter derivatives contracts. Even tough, the numbers related to gold are running at hundreds of billions USD for notional amounts and tens of billions USD for gross market values.

This report is the least mentioned by gold commentators but it is the most important of all in my opinion, the reason? - The sums of money involved in the OTC gold derivatives market dwarfs both total supply demand annual volume and the full impact of gold hedging.

The OTC derivatives report is insightful for the reason it reveals the extremely large size of gold obligations, the numbers are so big that you can be assured that the gold bull market will last many years.

Gold over the counter derivatives report by BIS

CHEUVREUX Gold Report

This report by investment analyst Paul Mylchreest is not less then ground breaking. The report which was published early this year, carry the sub title - "Start Hoarding" and clearly present the bullish case for gold. – Well worth reading.

CHEUVREUX Gold Report

Entities mentioned

The Bank for International Settlements (BIS) is an international organization which fosters international monetary and financial cooperation and serves as a bank for central banks.

The World Gold Council (WGC), a commercially-driven marketing organization, is funded by the world’s leading gold mining companies.

GFMS is a precious metals consultancy, specializing in research of the global gold, silver, platinum and palladium markets.

Virtual Metals is a group of analysts specializing in precious and base metals, energy and soft commodities.

Mitsui Global Precious Metals is part of the Mitsui group and conducts its business in the precious metal market; it is also Japan's largest manager of commodity funds.

Fortis is an international provider of banking and insurance services to personal, business and institutional customers.

Haliburton Mineral Services Inc. is a private mining research and advisory business based in Toronto, Canada.

CHEUVREUX - equity broking and investment firm, subsidiary of Calyon and a member of the Crédit Agricole SA group.

Thursday, June 29, 2006

Gold Chart & Gold Market Commentary

I just noticed that the Bank of International settlements (BIS) have published a new paper on over the counter derivatives including gold and other commodities. I will study the report and publish my thoughts and conclusions. You can see my thoughts on the previous BIS OTC report here :

http://globalgold.blogspot.com/2005/12/great-gold-paradox-part-ii.html

Here is a link for June 2006 BIS OTC report

http://www.bis.org/statistics/derstats.htm

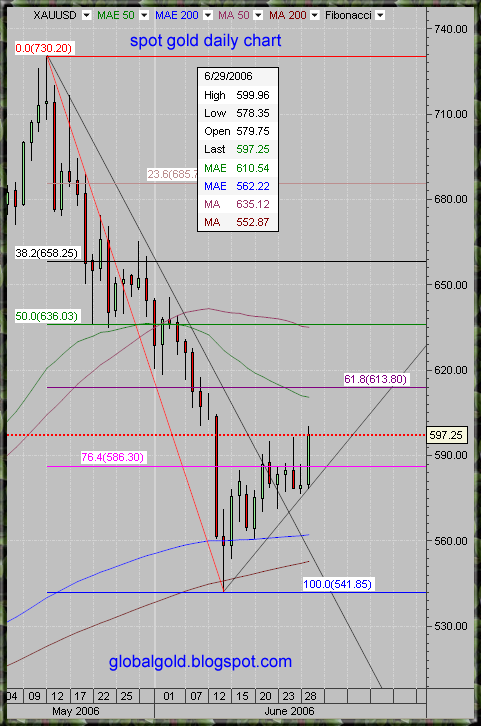

In my opinion gold is headed higher to new highs but it will have to struggle with resistance and profit taking along the way. Traders should concentrate on carefully buying bottoms and taking partial profits along the way. Gold is again above the 76.4% Fibonacci line which should provide good support for any impending pullback.

You can contact me regarding any issue - Email

Tuesday, January 24, 2006

Gold Short positions

Here is a summery of the open Interest for the COMEX (NY) , CBOT and TOCOM (Japan), Options are not included.

COMEX (CFTC) : 361,704 x 100 oz = 36,170,400 oz

CBOT : (12,404 x 100 oz = 1,240,400 oz + 4,853 x 33.2 oz = 161119.6 oz) = 1,401,519.6 oz

TOCOM : 342,873 x 33 oz = 11,314,809 oz

COMEX + CBOT + TOCOM = 48,886,728 oz

Links :

BIS OTC DERIVATIVE REPORT REVIEW

DERIVATIVE OTC REPORT OCC

COMEX (CFTC)

CBOT

TOCOM

Wednesday, December 21, 2005

The great Gold paradox (part II)

1) The definitions are very general to say the least.

2) The data regarding Commodity contracts ( Gold & other) as well as E. “Other” (defined as : “ Include foreign exchange. Interest rate, equity and commodity derivatives of non reporting institutions, based on the triennial central bank survey on foreign exchange and derivative market activity”) is minimal.

3) Very little transparency.

However my insights are as follows:

1) The OTC derivatives market is huge and growing and might be accelerating! , Grant total notional amounts was 270.1 trillion US$ with Interest rate swaps contracts responsible for the majority (163.749 trillion $). Those numbers are very big compared to any other economic number on earth!

2) The grand total gross market value is much smaller at 10.694 Trillion, tough more volatile and could change quickly!

3) Total commodity contracts value is growing. Standing at 1.693 trillion for notional value and 271 billion for gross value. – note those are huge numbers but are representing just a few percents of the Grand Total for OTC derivatives.

4) Gold contracts, both notional and gross values declined standing at 288 Billion US$ and 24 Billion US$ respectively. Nevertheless those are big numbers representing 693 million gold ounces for notional value and 57 million ounces for gross value. (Calculations based on a 415 $ / OZ at the end of June 05 ). A fairly big number considering total gold world wide production is just 82.5 million ounces annually.

5) Other commodities notional & gross values increased substantially. – We don’t really know what kinds of commodities are included but I guess they include oil and silver.

6) E.other standing at 27.793 trillion and 1.866 trillion for notional and gross values respectively. – the point is (and that’s a big point !) we cant know how many gold & commodities are hiding inside this numbers.

7) The data is super non transparent , but one could feel lucky to have any data at all. The fact is that Gold and other commodities continue to be very important for the global monetary system and one should not rule out a renewed gold standard or something similar , It will be Interesting to see how higher (possibly much higher!) gold price affect the BIS report and the financial health of those holding a short gold position.

Please review the latest BIS OTC derivatives review - (pay special attention for sections D & E of table 1 on page 10.)

yours + real1

The great Gold paradox (part I)

So in 1971 a great economic experiment have started – a completely ‘free’ global money system where central banks, commercial banks and politicians have a very high level of flexibility to control the amounts of money .

Needless to say the result over the last 35 years was an exponential growth of money amounts & Debts along a severe loss of money buying power (Inflation).

However, central banks continue to hold large amount of gold reserves (for a very good reason!) just in case this ‘great’ experiment will fail…

Please review the latest BIS OTC derivatives review - (pay special attention for sections D & E of table 1 on page 10.)

More later... real1

Sunday, December 18, 2005

For millennia, gold has served as money and is also used in jewelry, dentistry, and in electronics. Gold forms the basis for a monetary standard used by the International Monetary Fund (IMF) and the Bank for International Settlements (BIS). Its ISO currency code is XAU.

here is what the IMF have to say about gold :

- The IMF's policy on gold is governed by the following principles:

As an undervalued asset held by the IMF, gold provides fundamental strength to its balance sheet. Any mobilization of IMF gold should avoid weakening its overall financial position. - The IMF should continue to hold a relatively large amount of gold among its assets, not only for prudential reasons, but also to meet unforeseen contingencies.

- The IMF has a systemic responsibility to avoid causing disruptions to the functioning of the gold market.

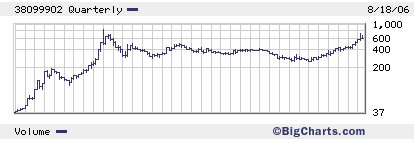

35 years price history of gold (Courtesy of bigcharts.com)

more later, real1.