Interesting story coming from Taiwan:

2006/5/19

The China Post staff

To melt or not to melt: That's the question.

Well, it's the question of the day.

What to melt?

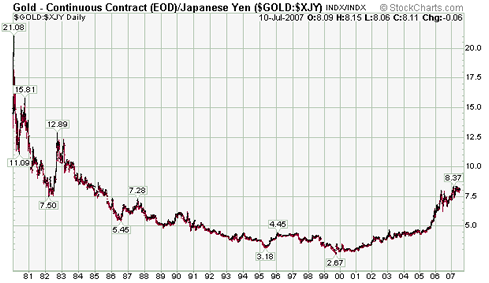

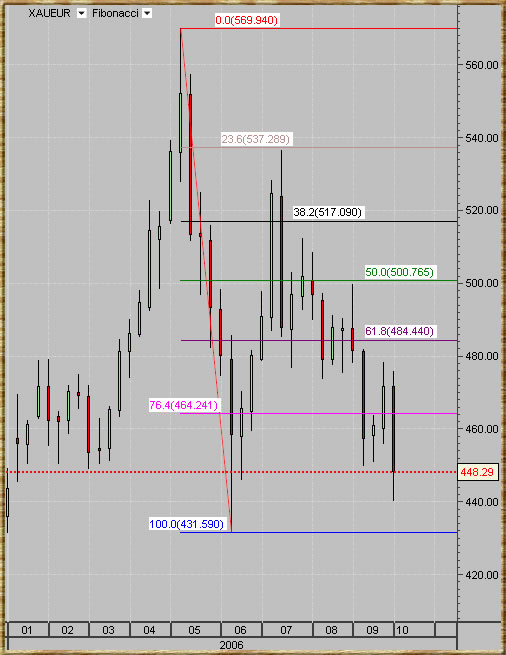

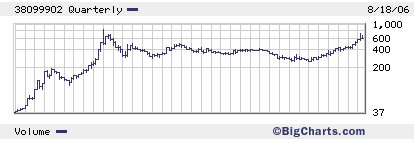

Small coins, of course, now that the prices of copper, nickel and aluminum have soared just as gold and silver did.

Whether the melting has started in Taiwan on a scale large enough to cash in on the surge of metal prices is not known, but non-numismatist entrepreneurs certainly are looking into the possibilities of amassing a trove of small change to make the quick buck.

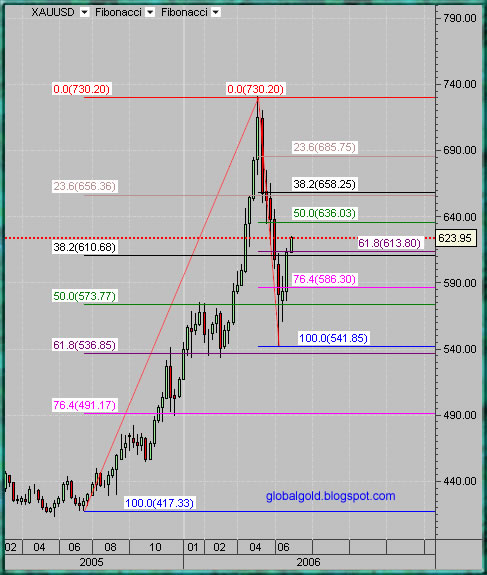

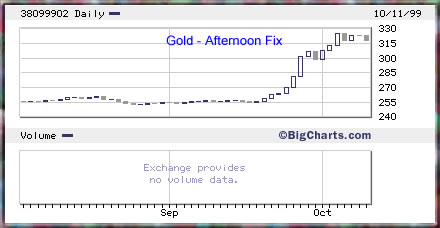

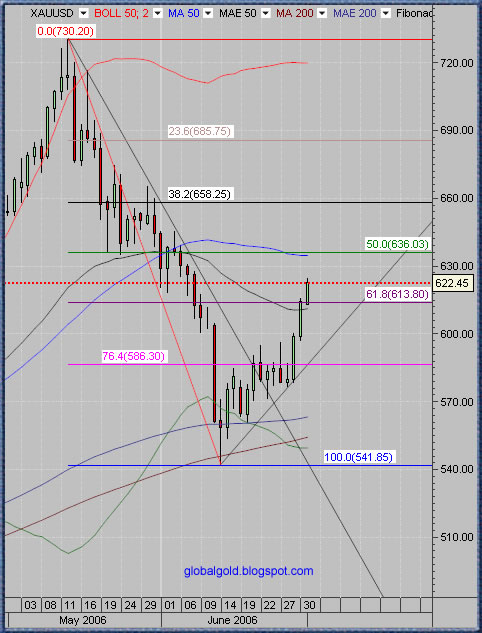

With the gold price hitting US$700 an ounce, one kilogram of lowly nickel can fetch close to ten pounds sterling -- 9 pounds 45.7 pence to be exact -- in London, where the same weight of once cheap copper is sold at three pounds 89.6 pence.

Ubiquitous aluminum? One pound 35 pence a kilo.

That makes it lucrative to get hold of at least one million NT$1 coins, melt them and sell them as ingots, according to an enterprising newly converted numismatist.

"You spend only NT$1 million," says the entrepreneur. "And you get NT$1.26 million."

But he doesn't say he has set up shop.

It's much better to melt half-dollar NT coins, he adds.

They are a little smaller in size than the NT$1 coins, but a half-dollar melted is worth NT$0.93 or 43 cents more than its par value.

The reason is that you have to have at least 3.8 metric tons of change to make your melting business go. You spend much less to get that much if you collect only half-dollars.

That is not quite right, the Central Bank of China points out.

For one thing, it's against the law.

Anyone found to have purposely destroyed the legal tender shall be sentenced to not over one year but not less than seven years in prison, the law says.

Moreover, a Central Bank expert says, it's not profitable at all to melt and sell.

The expert continues copper accounts for 92 percent of the 3.8 tons of NT$1 coins. They contain 6 percent of nickel and 2 percent of aluminum.

"In other words," the Central Bank official goes on, "there will be 3.496 tons of copper, 228 kilograms of nickel and 76 kilograms of aluminum."

Sold on the London market, they would bring in only NT$952,738. The breakdown is NT$817,225 for copper, NT$129,371 for nickel, and NT$6,142 for aluminum.

The net loss is NT$47,262. If freight is added, the loss will be even greater.

Wait a minute, the entrepreneur says.

"He may be right," the enterprising numismatist adds, "but you will do much, much better, if you collect the old NT$1 coins."

The old coin, known as the plum change for the flower on the back side, is no longer in use as the legal tender. "You don't have to worry about the long arm of the law," he adds.

It's heavier, six grams against only 3.8 grams of the coin in circulation.

As a result, NT$1 million worth of plum coins weigh up to six metric tons, of which 3.3 tons are copper. There are 1.08 tons of nickel and 1.62 tons of aluminum.

Altogether NT$1,904,164 will be made by getting NT$1 million worth of plum coins, melt them and sell them in ingots in London.

And there's a historical precedent.

In 1973, copper and nickel prices soared, and so many plum coins were melted and sold in ingots in Taiwan that an acute shortage of change resulted.

Butchers and grocers in Taipei came up with a clever way to make up for the shortage of change they have to give back to overpaying customers.

They printed their NT$1 IOUs. Their customers gladly accepted them. -

source