Showing posts with label HUI. Show all posts

Showing posts with label HUI. Show all posts

Thursday, January 11, 2007

Tuesday, October 03, 2006

Dow/Gold , Gold/Oil Ratios – Update

1) The Dow Jones Industrial Average made a new all times closing high of 11,727.

2) Gold is sharply lower. Cbot gold trading had another serious malfunction today (not the first one this year…), AMEX GOLD BUGS INDEX is down 6.67% for the day.

3) The Dow / Gold ratio is nearing completion of an A-B-C correction wave – in my opinion.

4) The Gold/Oil ratio closed above its 200 weekly moving average for the first time since early 2004.

for more information and charts of gold ratios, See this post : The importance of the Dow Jones / Gold, Gold / Oil & Gold / Silver ratios.

See also HUI/Gold ratio.

2) Gold is sharply lower. Cbot gold trading had another serious malfunction today (not the first one this year…), AMEX GOLD BUGS INDEX is down 6.67% for the day.

3) The Dow / Gold ratio is nearing completion of an A-B-C correction wave – in my opinion.

4) The Gold/Oil ratio closed above its 200 weekly moving average for the first time since early 2004.

for more information and charts of gold ratios, See this post : The importance of the Dow Jones / Gold, Gold / Oil & Gold / Silver ratios.

See also HUI/Gold ratio.

Wednesday, August 16, 2006

Gold and Silver Mining Stocks

Dear readers, I'm deeply sorry for posting less lately.

I decided to trade more and post less.

See the latest HUI technical overview.

I will do my best to keep you up to date with any major gold technical and fundamentals developments.

I decided to trade more and post less.

See the latest HUI technical overview.

I will do my best to keep you up to date with any major gold technical and fundamentals developments.

Saturday, July 29, 2006

Wednesday, July 19, 2006

Gold and Silver Intraday Charts

Dear readers,

Below are Gold and Silver Spot charts. Technically both gold and silver broke up above the downtrend resistance line and it's seems that the short term correction is over. I'm still evaluating the situation and will update later. Meanwhile you can refer to previous posts for longer term charts and observations.

See this morning HUI & GDX technical Update

Click on the charts below for enlarged view.

Below are Gold and Silver Spot charts. Technically both gold and silver broke up above the downtrend resistance line and it's seems that the short term correction is over. I'm still evaluating the situation and will update later. Meanwhile you can refer to previous posts for longer term charts and observations.

See this morning HUI & GDX technical Update

Click on the charts below for enlarged view.

Thursday, February 09, 2006

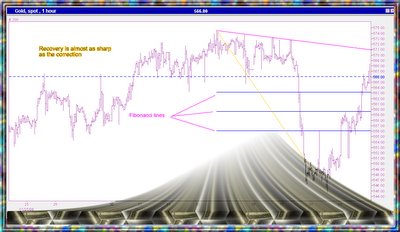

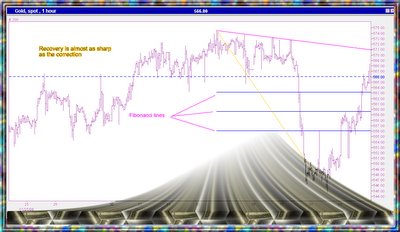

Gold spot one hour chart

Gold and silver Recovery is almost as sharp as the correction. The violent down move was clearly non sustainable and counter move quickly followed. If you trade this market using margin use it very wisely if any. As the bull market continue it is very logical to expect similar moves and even more volatile market. Gold outperformed both the XAU index and the HUI index today, in my opinion it is not a sign of weakness but a possibility that investors preferences are changing and the metals are set to outperform the stocks , time will tell…

Click on the chart below to enlarge:

Special risks when investing in a mining company

Indonesia seeks revised Freeport-McMoRan profit-sharing deal

Click on the chart below to enlarge:

Special risks when investing in a mining company

Indonesia seeks revised Freeport-McMoRan profit-sharing deal

Wednesday, December 21, 2005

The gold stock indices

There are 3 main gold stocks( gold and sometimes silver mining companies) Indices: CBOE GOLD INDEX(GOX) , AMEX GOLD BUGS INDEX(HUI) and the most known PHLX GOLD AND SILVER SECTOR IND (XAU).

The fact that the gold stock indices had very small correction is a positive sign for the near future price of gold ( the gold indices tend to lead the gold price most of the time).

Not much have changed today with the price of gold but gold indices moved higher.

Please note that gold & silver stocks are very different from the metals for a wide range of reasons : production cost , declining reserves, politics , hedging, human factor – to name a few... , However it’s interesting to follow their performance for general market sentiment.

The fact that the gold stock indices had very small correction is a positive sign for the near future price of gold ( the gold indices tend to lead the gold price most of the time).

Not much have changed today with the price of gold but gold indices moved higher.

Please note that gold & silver stocks are very different from the metals for a wide range of reasons : production cost , declining reserves, politics , hedging, human factor – to name a few... , However it’s interesting to follow their performance for general market sentiment.

Subscribe to:

Posts (Atom)