Gold trading is directionless, sentiment is negative as I observe at mainstream media publications.

Gold markets structural developments:

Small-Lot Gold Futures

100 gram gold contracts to be issued in China and Japan :

"BEIJING, June 26 -- The Shanghai Gold Exchange will launch individual gold bullion trading nationwide in July by teaming up with Industrial Bank."

-source

"TOCOM hopes to inaugurate the new section, aimed at attracting individual investors with reduced trading risks, on July 9. The basic trading unit will be lowered to 100 grams from one kilogram for the existing gold futures. The per-lot margin will be fixed at 12,000 yen for July compared with 90,000 yen for the existing market. Transactions will be settled with cash, not with physical delivery. The daily price fluctuation range will be initially set at 120 yen, twice as wide as for the existing gold futures."

-source

India Gold ETF's

"Sandesh Kirkire, CEO of Kotak Mahindra AMC:

Q: Can you put into perspective as to how much you would actually be investing in physical gold and how much would be in money markets?

A: I think a significant portion will be in physical gold and very marginal amount will remain in cash and cash equivalents. "

-source

Showing posts with label India. Show all posts

Showing posts with label India. Show all posts

Tuesday, June 26, 2007

Saturday, February 03, 2007

Gold Market News Summery

Dear readers,

It was a busy month! , Posted below are some of the latest international gold market news:

IMF to make central bank gold lending data more transparent

Blanchard & Company study calling for greater transparency in central bank gold lending accounting has apparently helped to convince the International Monetary Fund to adopt a landmark accounting change in the way central banks account for gold loans.

http://www.mineweb.net/american_notes/596209.htm

IMF advised to sell 400 tonnes of gold

http://www.imf.org/external/np/tr/2007/tr070131.htm

http://www.thepeninsulaqatar.com/Display_news.asp?section=Business_News&subsection=market+news&month=February2007&file=Business_News2007020293025.xml

Britains Chancellor of the Exchequer (Finance Secretary) Gordon Brown was accused in the House of Commons Thursday of losing the equivalent of over 4.5 billion dollars by selling gold assets when prices were low.

http://www.kuna.net.kw/home/Story.aspx?Language=en&DSNO=945883

Euro bank breaks rank, buys gold?

http://www.smh.com.au/news/business/euro-bank-breaks-rank-buys-gold/2007/01/03/1167777153474.html

New gold products…

World Gold Council may offer new funds in Europe and India

http://www.bbj.hu/main/news_21208_world%2Bgold%2Bcouncil%2Bmay%2Boffer%2Bnew%2Bfunds%2Bin%2Beurope%2Band%2Bindia.html

Amfi expects launch of gold ETFs in Feb

http://economictimes.indiatimes.com/Markets/Commodities/Amfi_expects_launch_of_gold_ETFs_in_Feb/articleshow/1144457.cms

NCDEX to launch 10 gm gold contract

http://economictimes.indiatimes.com/Markets/Commodities/NCDEX_to_launch_10_gm_gold_contract/articleshow/1011695.cms

It was a busy month! , Posted below are some of the latest international gold market news:

IMF to make central bank gold lending data more transparent

Blanchard & Company study calling for greater transparency in central bank gold lending accounting has apparently helped to convince the International Monetary Fund to adopt a landmark accounting change in the way central banks account for gold loans.

http://www.mineweb.net/american_notes/596209.htm

IMF advised to sell 400 tonnes of gold

http://www.imf.org/external/np/tr/2007/tr070131.htm

http://www.thepeninsulaqatar.com/Display_news.asp?section=Business_News&subsection=market+news&month=February2007&file=Business_News2007020293025.xml

Britains Chancellor of the Exchequer (Finance Secretary) Gordon Brown was accused in the House of Commons Thursday of losing the equivalent of over 4.5 billion dollars by selling gold assets when prices were low.

http://www.kuna.net.kw/home/Story.aspx?Language=en&DSNO=945883

Euro bank breaks rank, buys gold?

http://www.smh.com.au/news/business/euro-bank-breaks-rank-buys-gold/2007/01/03/1167777153474.html

New gold products…

World Gold Council may offer new funds in Europe and India

http://www.bbj.hu/main/news_21208_world%2Bgold%2Bcouncil%2Bmay%2Boffer%2Bnew%2Bfunds%2Bin%2Beurope%2Band%2Bindia.html

Amfi expects launch of gold ETFs in Feb

http://economictimes.indiatimes.com/Markets/Commodities/Amfi_expects_launch_of_gold_ETFs_in_Feb/articleshow/1144457.cms

NCDEX to launch 10 gm gold contract

http://economictimes.indiatimes.com/Markets/Commodities/NCDEX_to_launch_10_gm_gold_contract/articleshow/1011695.cms

Wednesday, November 29, 2006

GOLD: Germany , India & Elliott Waves

Dear readers

Please review :

MUMBAI, NOV 28: Underscoring the benefits of diversifying foreign exchange reserves and the uniqueness of gold component as part of the forex basket , SS Tarapore, former deputy governor, Reserve Bank of India and economist, has strongly advocated for increasing the proportion of gold in the country’s forex reserve. He was speaking at a conference on Foreign Exchange Management: The Way Forward, on Tuesday.

In the past, country’s forex reserves have jumped significantly but the gold holding in it has now dwindled to as low as 3.6%. “If the gold proportion of the RBI’s forex reserves were cautiously raised, to say 10% of total reserves, it would require an additional purchase of gold by the RBI of $10 to 11 billion,” he said. -source

Please review :

- Tarapore, former deputy governor, Reserve Bank of India and economist, has strongly advocated for increasing the proportion of gold in the country’s forex reserve.

MUMBAI, NOV 28: Underscoring the benefits of diversifying foreign exchange reserves and the uniqueness of gold component as part of the forex basket , SS Tarapore, former deputy governor, Reserve Bank of India and economist, has strongly advocated for increasing the proportion of gold in the country’s forex reserve. He was speaking at a conference on Foreign Exchange Management: The Way Forward, on Tuesday.

In the past, country’s forex reserves have jumped significantly but the gold holding in it has now dwindled to as low as 3.6%. “If the gold proportion of the RBI’s forex reserves were cautiously raised, to say 10% of total reserves, it would require an additional purchase of gold by the RBI of $10 to 11 billion,” he said. -source

Saturday, November 25, 2006

Gold Market News

COMEX Metal Futures on the CME Globex Platform

New York, N.Y., November 21, 2006 -- The New York Mercantile Exchange, Inc. announced today that it will expand COMEX metals electronic trading to include side by side trading, COMEX miNYs, Asian metals, and London metals futures contracts on the CME Globex® electronic trading platform beginning on December 3 for trade date December 4.

NYMEX will migrate the COMEX gold, silver, copper and aluminum futures contracts, which currently trade after hours on the NYMEX ACCESS® electronic trading system to CME Globex. These contracts will also be offered on CME Globex during open outcry hours, trading virtually 24 hours a day. -source

Related - * CME and C(BOT) to Merge

NCDEX opens futures contracts for gold and silver

TUESDAY, NOVEMBER 21

MUMBAI: National Commodity & Derivatives Exchange Ltd (NCDEX) launched two new precious metal futures contracts on Tuesday aimed at retail investors, an exchange official said.

The new products, a 100-gram gold contract and a five-kg silver contract, join several heavier denomination contracts for the two metals on NCDEX. "This is aimed at retail investors, since every household in India feels the need to invest in precious metals," said, Narendra Gupta, chief of strategy.

Both products would have contracts for every month with the expiry set for the 20th of the delivery month. -source

IMF Should Sell Gold to Cover Looming Losses, Directors Say

By Christopher Swann

Nov. 22 (Bloomberg) -- The International Monetary Fund, the world's third-largest owner of gold, should sell some of its hoard to cover projected operating losses, say a growing number of the fund's executive directors.

The Washington-based lender predicts it will lose $87.5 million next year and $280 million in 2009. Some directors say the fund should sell a portion of its 103 million ounces of gold, valued at $64.7 billion, and invest the proceeds in interest- bearing assets.

``We would support the use of fund gold as part of the solution to IMF financial needs,'' Tuomas Saarenheimo of Finland, chairman of a group that coordinates the position of European Union members on the fund's 24-person board, said in an interview in Washington... -source

New York, N.Y., November 21, 2006 -- The New York Mercantile Exchange, Inc. announced today that it will expand COMEX metals electronic trading to include side by side trading, COMEX miNYs, Asian metals, and London metals futures contracts on the CME Globex® electronic trading platform beginning on December 3 for trade date December 4.

NYMEX will migrate the COMEX gold, silver, copper and aluminum futures contracts, which currently trade after hours on the NYMEX ACCESS® electronic trading system to CME Globex. These contracts will also be offered on CME Globex during open outcry hours, trading virtually 24 hours a day. -source

Related - * CME and C(BOT) to Merge

NCDEX opens futures contracts for gold and silver

TUESDAY, NOVEMBER 21

MUMBAI: National Commodity & Derivatives Exchange Ltd (NCDEX) launched two new precious metal futures contracts on Tuesday aimed at retail investors, an exchange official said.

The new products, a 100-gram gold contract and a five-kg silver contract, join several heavier denomination contracts for the two metals on NCDEX. "This is aimed at retail investors, since every household in India feels the need to invest in precious metals," said, Narendra Gupta, chief of strategy.

Both products would have contracts for every month with the expiry set for the 20th of the delivery month. -source

IMF Should Sell Gold to Cover Looming Losses, Directors Say

By Christopher Swann

Nov. 22 (Bloomberg) -- The International Monetary Fund, the world's third-largest owner of gold, should sell some of its hoard to cover projected operating losses, say a growing number of the fund's executive directors.

The Washington-based lender predicts it will lose $87.5 million next year and $280 million in 2009. Some directors say the fund should sell a portion of its 103 million ounces of gold, valued at $64.7 billion, and invest the proceeds in interest- bearing assets.

``We would support the use of fund gold as part of the solution to IMF financial needs,'' Tuomas Saarenheimo of Finland, chairman of a group that coordinates the position of European Union members on the fund's 24-person board, said in an interview in Washington... -source

Tuesday, July 04, 2006

Gold and Central Banks

S.P from India Submits:

" I like your blog a lot and visit it to see your charts to guess the gold moves. I don't trade futures but interested in buying gold.

But presently, there seem to be no signs that the world will ever move towards a gold standard. The problems of the world itself are so huge to even think of going in that direction. The easier solution is being adopted and everyone is using their printing presses :)

I saw recently that even India increased money supply by 20% this year.

Do you see the gold breaking the 540 support in the next 1 year? The recent jump from support was gr8. I read somewhere that the recent dump, came because the British government decided to sell its gold partly, do you agree to it? "

India is a major power in the global economy particularly in the gold market. As most readers probably know India is the world's largest market for physical gold.

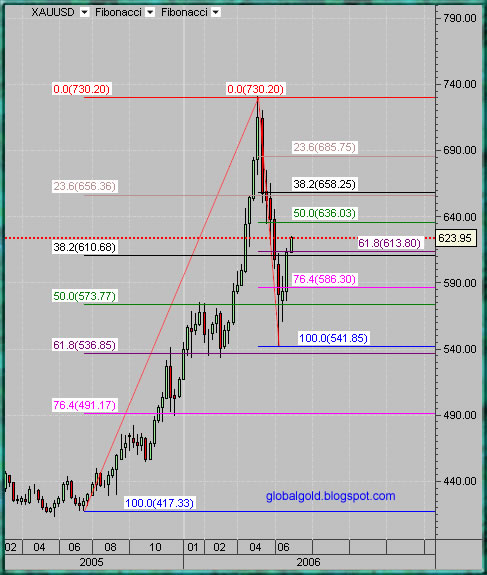

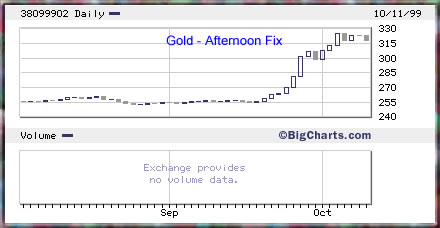

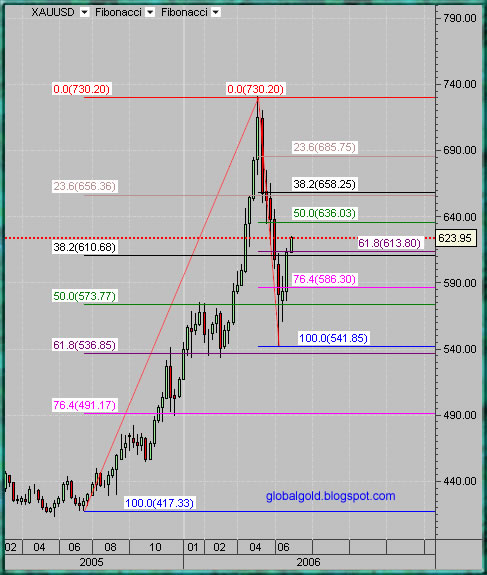

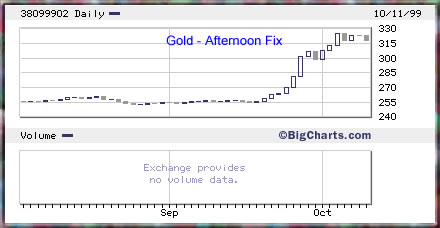

Central Banks are actively participating in the gold market, some as sellers and some as buyers. The European Central Banks have signed several agreements regarding gold selling. The first agreement was signed at September 1999 and ignited a strong rally(see chart below).

The UK signed the first Agreement but not the second (at the time the second Agreement was announced it stated that the UK government has no plans to sell gold).

I did not notice any press release regarding new UK gold sales so I can't agree with rumors. But they can certainly sell secretly (If they got any gold left)

OFFICIAL AGREEMENTS ON GOLD

Other Central Banks like Russia, China and UAE are buying or at least talking about buying gold.

Overall Gold continues to play an important monetary role and its importance is increasing along price - in my opinion. Yes, you are right, currently there is no sign of officially going back to the gold standard. However, one should not rule out a renewed gold standard or something similar.

Mr. Gary Dorsch published an interesting article which shows some interesting relations between global assets prices and gold. I had also posted about this subject and you can freely browse this blog archive.

See also : The importance of the Dow Jones / Gold, Gold / Oil & Gold / Silver ratios

Latest gold market headlines:

China, Raise gold holdings

China should take advantage of any weakness in bullion prices to build up its official gold holdings as part of a strategy for diversifying its foreign exchange reserves, a senior government economist said Monday.

Tuesday, July 04, 2006

China should take advantage of any weakness in bullion prices to build up its official gold holdings as part of a strategy for diversifying its foreign exchange reserves, a senior government economist said Monday.

Xia Bin, head of the financial research institute of the Development Research Center, a think tank under the Cabinet, also proposed that Beijing allow the yuan to fluctuate within a wider range against the dollar.

"It is practical for China to increase its holdings of gold by choosing an appropriate time to buy, because compared with other big trading countries the percentage of gold in China's reserves is seriously low," Xia said in an article on his agency's Web site.

Xia also suggested China establish an international investment fund with the aim of increasing returns from its US$900 billion-plus (HK$7.02 trillion) stockpile of reserves.

Chinese individuals should be permitted to buy into the fund, which would allow them to hold foreign exchange indirectly, he wrote. -source

Bank of Portugal sells 15 tonnes of gold

07/04/06 11:12 am (GMT)

LISBON (AFX) - The Bank of Portugal said it has sold 15 tonnes of gold from its reserves in the last few months.

The bank said the sales were aimed at diversifying its external reserves, with the proceeds to be kept in a special reserve at the central bank.

Last December, the bank sold 10 tonnes of gold.

The sales were carried out as part of the European Central Bank's agreement on gold sales which limits annual gold sales to 500 tonnes up to 2009. -source

Technically the daily chart from two days ago shows a Three White Soldiers - Bullish reversal pattern (high reliability)

If you look at the weekly spot gold chart below what I see is a relatively good support between the 61.8% fibonnaci line on the short set and the 38.2% on the long set (610$ -613$). If that support doesn’t hold then gold will probably go down to the lower Fibonacci lines (573$ - 586$). Slight resistance around 636$ and more resistance at 656$ - 658$.

" I like your blog a lot and visit it to see your charts to guess the gold moves. I don't trade futures but interested in buying gold.

But presently, there seem to be no signs that the world will ever move towards a gold standard. The problems of the world itself are so huge to even think of going in that direction. The easier solution is being adopted and everyone is using their printing presses :)

I saw recently that even India increased money supply by 20% this year.

Do you see the gold breaking the 540 support in the next 1 year? The recent jump from support was gr8. I read somewhere that the recent dump, came because the British government decided to sell its gold partly, do you agree to it? "

India is a major power in the global economy particularly in the gold market. As most readers probably know India is the world's largest market for physical gold.

Central Banks are actively participating in the gold market, some as sellers and some as buyers. The European Central Banks have signed several agreements regarding gold selling. The first agreement was signed at September 1999 and ignited a strong rally(see chart below).

The UK signed the first Agreement but not the second (at the time the second Agreement was announced it stated that the UK government has no plans to sell gold).

I did not notice any press release regarding new UK gold sales so I can't agree with rumors. But they can certainly sell secretly (If they got any gold left)

OFFICIAL AGREEMENTS ON GOLD

Other Central Banks like Russia, China and UAE are buying or at least talking about buying gold.

Overall Gold continues to play an important monetary role and its importance is increasing along price - in my opinion. Yes, you are right, currently there is no sign of officially going back to the gold standard. However, one should not rule out a renewed gold standard or something similar.

Mr. Gary Dorsch published an interesting article which shows some interesting relations between global assets prices and gold. I had also posted about this subject and you can freely browse this blog archive.

See also : The importance of the Dow Jones / Gold, Gold / Oil & Gold / Silver ratios

Latest gold market headlines:

China, Raise gold holdings

China should take advantage of any weakness in bullion prices to build up its official gold holdings as part of a strategy for diversifying its foreign exchange reserves, a senior government economist said Monday.

Tuesday, July 04, 2006

China should take advantage of any weakness in bullion prices to build up its official gold holdings as part of a strategy for diversifying its foreign exchange reserves, a senior government economist said Monday.

Xia Bin, head of the financial research institute of the Development Research Center, a think tank under the Cabinet, also proposed that Beijing allow the yuan to fluctuate within a wider range against the dollar.

"It is practical for China to increase its holdings of gold by choosing an appropriate time to buy, because compared with other big trading countries the percentage of gold in China's reserves is seriously low," Xia said in an article on his agency's Web site.

Xia also suggested China establish an international investment fund with the aim of increasing returns from its US$900 billion-plus (HK$7.02 trillion) stockpile of reserves.

Chinese individuals should be permitted to buy into the fund, which would allow them to hold foreign exchange indirectly, he wrote. -source

Bank of Portugal sells 15 tonnes of gold

07/04/06 11:12 am (GMT)

LISBON (AFX) - The Bank of Portugal said it has sold 15 tonnes of gold from its reserves in the last few months.

The bank said the sales were aimed at diversifying its external reserves, with the proceeds to be kept in a special reserve at the central bank.

Last December, the bank sold 10 tonnes of gold.

The sales were carried out as part of the European Central Bank's agreement on gold sales which limits annual gold sales to 500 tonnes up to 2009. -source

Technically the daily chart from two days ago shows a Three White Soldiers - Bullish reversal pattern (high reliability)

If you look at the weekly spot gold chart below what I see is a relatively good support between the 61.8% fibonnaci line on the short set and the 38.2% on the long set (610$ -613$). If that support doesn’t hold then gold will probably go down to the lower Fibonacci lines (573$ - 586$). Slight resistance around 636$ and more resistance at 656$ - 658$.

Monday, June 26, 2006

Gold , China & India

This two issues are potentially extremely significant:

Call to mix forex reserves

(Shanghai Daily)

Updated: 2006-06-26 10:19

China's bulging foreign-exchange reserves and massive holdings in US treasuries are prompting some economists and researchers to argue the nation should diversify part of its huge reserves into gold and oil.

China should consider buying more gold with its forex reserves to avoid any losses linked to possible devaluation of its US dollar-backed assets, two central bank officials said in a latest research note.

Using some of the forex reserves to buy gold could "maintain and raise the value of China's dollar holdings," Zhao Qingming from the central bank's Financial Research Institute and Luo Bin from its accounting department wrote in a note published in China Money Market this month.

Although it was still unclear whether the comment might signal any policy change by the People's Bank of China, the central bank, it has highlighted a growing concern over mounting risks in forex investments.

China has forex reserves of US$875 billion by the end of the first quarter this year, surpassing Japan's as the world's biggest.

The country now invests around 1.3 percent of its forex reserves in gold, or about 600 tons. That compares with 8,500-odd tons owned by the United States, which accounts for more than 70 percent of that country's forex reserves. -source

Mumbai: With two mutual fund houses planning to launch gold exchange traded funds (GETFs), investors can look forward to invest in a much safer asset class, after being taken on ride in the equity market.

Two Asset Management Companies (AMCs) UTI and Benchmark recently filed their offer documents with market regulator Securities and Exchange Board of India (SEBI) to launch GETFs, which invest in gold as its underlying asset and trades like any other exchange traded fund on the bourses. - source

Call to mix forex reserves

(Shanghai Daily)

Updated: 2006-06-26 10:19

China's bulging foreign-exchange reserves and massive holdings in US treasuries are prompting some economists and researchers to argue the nation should diversify part of its huge reserves into gold and oil.

China should consider buying more gold with its forex reserves to avoid any losses linked to possible devaluation of its US dollar-backed assets, two central bank officials said in a latest research note.

Using some of the forex reserves to buy gold could "maintain and raise the value of China's dollar holdings," Zhao Qingming from the central bank's Financial Research Institute and Luo Bin from its accounting department wrote in a note published in China Money Market this month.

Although it was still unclear whether the comment might signal any policy change by the People's Bank of China, the central bank, it has highlighted a growing concern over mounting risks in forex investments.

China has forex reserves of US$875 billion by the end of the first quarter this year, surpassing Japan's as the world's biggest.

The country now invests around 1.3 percent of its forex reserves in gold, or about 600 tons. That compares with 8,500-odd tons owned by the United States, which accounts for more than 70 percent of that country's forex reserves. -source

Mumbai: With two mutual fund houses planning to launch gold exchange traded funds (GETFs), investors can look forward to invest in a much safer asset class, after being taken on ride in the equity market.

Two Asset Management Companies (AMCs) UTI and Benchmark recently filed their offer documents with market regulator Securities and Exchange Board of India (SEBI) to launch GETFs, which invest in gold as its underlying asset and trades like any other exchange traded fund on the bourses. - source

Tuesday, May 30, 2006

XAU XAG Bullish Bias

Silver looks flaggy, have done some Elliott work with no final conclusion yet, but its hard to find a bearish wave count – If you get one please send it to me. On the broad view- it may be very hard to find an asset which has such a long term bullish formation like gold, on a second thought maybe silver if you discount liquidity. The gold market is entering a period of accelerated movements which will results in sharp and devastating sell offs but the price resolution will be pretty steady to the upwards – in this third wave which is half done at most – many new market participants starting to get in, this is the time that people who never thought about buying gold start to feel uncomfortable – the uncomfortably can be settled by buying gold. The recognition is eye opening , the knowledge might bring understanding.

Here some gold related news:

Growing over-the-counter gold trading a legal gray area in China

Shanghai. May 30. INTERFAX-CHINA - Many Chinese companies engaging in over-the-counter (OTC) gold trading are operating in legal limbo as current options cannot satisfy demand.

The Shanghai Gold Exchange (SGE) is the only institute authorized by the government to conduct gold trades. Those gold trades can only be carried out among SGE members, including banks and gold refiners and clients.

Many domestic gold investment companies (gold dealers) that are not members of the SGE, directly conduct OTC trades, which are over the telephone or by computer on the overseas markets. -source

MPS want 'online gold trading' to be stopped

(Press Trust of India Via Thomson Dialog NewsEdge)Madurai,May 29 (PTI) A Group of MPs have appealed to the Centre to immediately stop "online gold trading," which they described as "gambling" and "affected marriage of women in middle class families." In a memorandum to the Prime Minister, a copy of which was released to the media here, 12 Mps from Tamil Nadu, West bengal and Kerala said traders across the world were earning crores of rupees through their "monopolistic online trading", and they were mainly responsible for the steep hike in gold prices. -source

Gold is safe to invest in, say experts

Our Regional Bureau / Mumbai/ Ahmedabad May 30, 2006

Gujarat Chamber of Commerce & Industry and H L College Alumni Association, jointly organised a seminar on Current and Future Trends in Capital, Commodity and Metal Markets in city on Sunday.

C Chakrabarty, head of training and R&D, MCX said MCX has grown tremendously with its turnover increasing to Rs 10,000 crore and made an impact on the stock market.

He said gold is a safe commodity, high liquidity asset and also an international currency having world wide value acceptance. source

Charts below clickable:

Here some gold related news:

Growing over-the-counter gold trading a legal gray area in China

Shanghai. May 30. INTERFAX-CHINA - Many Chinese companies engaging in over-the-counter (OTC) gold trading are operating in legal limbo as current options cannot satisfy demand.

The Shanghai Gold Exchange (SGE) is the only institute authorized by the government to conduct gold trades. Those gold trades can only be carried out among SGE members, including banks and gold refiners and clients.

Many domestic gold investment companies (gold dealers) that are not members of the SGE, directly conduct OTC trades, which are over the telephone or by computer on the overseas markets. -source

MPS want 'online gold trading' to be stopped

(Press Trust of India Via Thomson Dialog NewsEdge)Madurai,May 29 (PTI) A Group of MPs have appealed to the Centre to immediately stop "online gold trading," which they described as "gambling" and "affected marriage of women in middle class families." In a memorandum to the Prime Minister, a copy of which was released to the media here, 12 Mps from Tamil Nadu, West bengal and Kerala said traders across the world were earning crores of rupees through their "monopolistic online trading", and they were mainly responsible for the steep hike in gold prices. -source

Gold is safe to invest in, say experts

Our Regional Bureau / Mumbai/ Ahmedabad May 30, 2006

Gujarat Chamber of Commerce & Industry and H L College Alumni Association, jointly organised a seminar on Current and Future Trends in Capital, Commodity and Metal Markets in city on Sunday.

C Chakrabarty, head of training and R&D, MCX said MCX has grown tremendously with its turnover increasing to Rs 10,000 crore and made an impact on the stock market.

He said gold is a safe commodity, high liquidity asset and also an international currency having world wide value acceptance. source

Charts below clickable:

Thursday, May 25, 2006

Gold & Silver News, Spot Silver Chart - XAG

Indian Bank to sell gold coins to boost profit

006-05-25 17:15

By Ruchira Singh

MUMBAI (Reuters) - Government-owned Indian Bank is hoping to set the slot machine ringing with the gold coin. In an attempt to boost business, the nearly 100-year old bank is stepping up retail sales of its recently launched gold coins, targeting a net income of 100 million rupees by the end of the fiscal year- source

World demand for silver soars

By Eileen Alt Powell

THE ASSOCIATED PRESS

NEW YORK — Demand for silver rose in 2005 to the highest level in five years as strength in jewelry and industrial products offset softness in photography and coins, the Silver Institute said Wednesday. The Washington, D.C.-based industry group also said its annual survey indicated that investor demand for silver has been increasing, just as it has been for gold. -source

Russia gold and currency reserves reach about 237 bln dlrs

5.05.2006, 10.05

MOSCOW, May 25 (Itar-Tass) - Russia’s gold and foreign currency reserves increased by 600 millon dollars (or by 0.25 percent) to reach 236.7 billion dollars in the period from May 12 to 19, PRIME-TASS reported on Thursday with reference to the Central Bank of Russia.

The reached size of gold and currency reserves is another record for the whole period of regular publications of this information by the Central Bank of Russia.

As compared to January 1, when the volume of Russia’s gold and foreign currency reserves was equal to 182.2 billion dollars, this figure has increased by about 29.9 percent. - source

Spot Silver chart annotated with Fibonacci levels, trend lines

and Elliott Wave count. Click on the chart below to enlarge:

006-05-25 17:15

By Ruchira Singh

MUMBAI (Reuters) - Government-owned Indian Bank is hoping to set the slot machine ringing with the gold coin. In an attempt to boost business, the nearly 100-year old bank is stepping up retail sales of its recently launched gold coins, targeting a net income of 100 million rupees by the end of the fiscal year- source

World demand for silver soars

By Eileen Alt Powell

THE ASSOCIATED PRESS

NEW YORK — Demand for silver rose in 2005 to the highest level in five years as strength in jewelry and industrial products offset softness in photography and coins, the Silver Institute said Wednesday. The Washington, D.C.-based industry group also said its annual survey indicated that investor demand for silver has been increasing, just as it has been for gold. -source

Russia gold and currency reserves reach about 237 bln dlrs

5.05.2006, 10.05

MOSCOW, May 25 (Itar-Tass) - Russia’s gold and foreign currency reserves increased by 600 millon dollars (or by 0.25 percent) to reach 236.7 billion dollars in the period from May 12 to 19, PRIME-TASS reported on Thursday with reference to the Central Bank of Russia.

The reached size of gold and currency reserves is another record for the whole period of regular publications of this information by the Central Bank of Russia.

As compared to January 1, when the volume of Russia’s gold and foreign currency reserves was equal to 182.2 billion dollars, this figure has increased by about 29.9 percent. - source

Spot Silver chart annotated with Fibonacci levels, trend lines

and Elliott Wave count. Click on the chart below to enlarge:

Monday, May 22, 2006

Gold Market News

Do you feel the concentrated efforts to scare the market and calm down speculation in all markets by authorities and international banks?

To some degree Interests rates and short term liquidity can be controlled. however some of the market fundamentals can not be manipulated. Therefore it is still a good idea to look for trading and investment opportunities in all markets especially commodities with bullish fundamentals and favorable supply demand conditions.

Regarding Gold, here are some of the latest global gold market news from around the world:

RTS to launch gold, oil futures June 8

MOSCOW. May 22 (Interfax) - The Russian Trading System (RTS) will launch futures and options in gold and oil on June 8, the RTS said in a press release.

"We plan to launch oil and gold futures in June," Jacques Der Megreditchian, the RTS board chairman, told Interfax earlier. These will be the first in a series of planned commodity futures, he said. The RTS will base its settlement prices for oil futures on quotations from the Platts agency, he said.

Troika Dialog, an investment company where Der Megreditchian is managing director, said Troika Dialog would be the market-maker for the contracts. "We'll be acting as the market-maker and we'll be hedging in London and New York," he said.

The RTS also plans to trade futures in diesel fuel, aviation fuel and fuel oil. -InterFax

Indian first Gold Fund

Posted: Sun, 21 May 2006

[miningmx.com] -- DETAILS of India's gold-backed equity were released to the market after the scheme's backer, Benchmark Mutual, filed papers with the Securities and Exchange Board of India.

The scheme, which is effectively India's first exchange traded fund (ETF), said the scheme includied plans to impose levies on entry and exit from the ETF.

The Financial Express, a Mumbai newspaper, said the product would levy a 4% entry load and 3% exit load on the Gold Benchmark Exchange Traded Scheme (Gold BeES), as the product is called.

Gold BeEs is an open-ended scheme that will list on the National Stock Exchange (NSE). Like the exchange traded fund it will invest in physical gold, the Financial Express said.

"The scheme seeks to generate returns that closely correspond to the returns provided by the domestic price of gold. At least 90% of the corpus will be held in physical gold, while the rest can be deployed in bonds and money market securities," the newspaper said. Each unit of Gold BeES will have a face value of Rs 100. Minimum investment is Rs 10,000 and in multiples of Rs 1,000 thereafter, it said. - source

Saudi firm buys gold from African central bank

Mon May 22, 2006 12:24 PM GMT

RIYADH (Reuters) - A private Saudi jeweller has bought 36 tonnes of raw gold from an African central bank for 1.8 billion riyals, a company spokesman said on Monday, confirming a newspaper report.

When asked about the report in leading Saudi business daily al-Eqtisadiah, the spokesman said: "That is correct."

He declined to elaborate.

The newspaper quoted Suleiman al-Othaim, board chairman of the Riyadh-based al-Othaim Gold and Jewellery firm, as saying the gold would be delivered in the fourth quarter of this year.

"The deal was concluded directly (with the unidentified African central bank) without any intermediary," the newspaper quoted him as saying.

It did not say when the transaction took place. -source

See Uranium & Titanium Stocks: CCJ , TIE

To some degree Interests rates and short term liquidity can be controlled. however some of the market fundamentals can not be manipulated. Therefore it is still a good idea to look for trading and investment opportunities in all markets especially commodities with bullish fundamentals and favorable supply demand conditions.

Regarding Gold, here are some of the latest global gold market news from around the world:

RTS to launch gold, oil futures June 8

MOSCOW. May 22 (Interfax) - The Russian Trading System (RTS) will launch futures and options in gold and oil on June 8, the RTS said in a press release.

"We plan to launch oil and gold futures in June," Jacques Der Megreditchian, the RTS board chairman, told Interfax earlier. These will be the first in a series of planned commodity futures, he said. The RTS will base its settlement prices for oil futures on quotations from the Platts agency, he said.

Troika Dialog, an investment company where Der Megreditchian is managing director, said Troika Dialog would be the market-maker for the contracts. "We'll be acting as the market-maker and we'll be hedging in London and New York," he said.

The RTS also plans to trade futures in diesel fuel, aviation fuel and fuel oil. -InterFax

Indian first Gold Fund

Posted: Sun, 21 May 2006

[miningmx.com] -- DETAILS of India's gold-backed equity were released to the market after the scheme's backer, Benchmark Mutual, filed papers with the Securities and Exchange Board of India.

The scheme, which is effectively India's first exchange traded fund (ETF), said the scheme includied plans to impose levies on entry and exit from the ETF.

The Financial Express, a Mumbai newspaper, said the product would levy a 4% entry load and 3% exit load on the Gold Benchmark Exchange Traded Scheme (Gold BeES), as the product is called.

Gold BeEs is an open-ended scheme that will list on the National Stock Exchange (NSE). Like the exchange traded fund it will invest in physical gold, the Financial Express said.

"The scheme seeks to generate returns that closely correspond to the returns provided by the domestic price of gold. At least 90% of the corpus will be held in physical gold, while the rest can be deployed in bonds and money market securities," the newspaper said. Each unit of Gold BeES will have a face value of Rs 100. Minimum investment is Rs 10,000 and in multiples of Rs 1,000 thereafter, it said. - source

Saudi firm buys gold from African central bank

Mon May 22, 2006 12:24 PM GMT

RIYADH (Reuters) - A private Saudi jeweller has bought 36 tonnes of raw gold from an African central bank for 1.8 billion riyals, a company spokesman said on Monday, confirming a newspaper report.

When asked about the report in leading Saudi business daily al-Eqtisadiah, the spokesman said: "That is correct."

He declined to elaborate.

The newspaper quoted Suleiman al-Othaim, board chairman of the Riyadh-based al-Othaim Gold and Jewellery firm, as saying the gold would be delivered in the fourth quarter of this year.

"The deal was concluded directly (with the unidentified African central bank) without any intermediary," the newspaper quoted him as saying.

It did not say when the transaction took place. -source

See Uranium & Titanium Stocks: CCJ , TIE

Saturday, May 20, 2006

Gold and Silver Mining Stocks -Few Gold, Silver stocks charts for the weekend

Gold, Commodities Blame Game?

See this story : Zimbabwe Jan-April gold output tumbles by a third

MUMBAI (Reuters) - Benchmark Asset Management Co. Pvt. Ltd. on Friday filed papers with India's market regulator for approval to launch an exchange-traded gold fund.

In its initial offer document, Benchmark said the fund would track the domestic prices by investing in physical gold.

Each unit of 'Gold Benchmark Exchange-Traded Scheme' would be equal to the price of one gram gold.

The unit would have a face-value of 100 rupees and priced around the value of gold, Benchmark said in a document filed with Securities and Exchange Board of India. (SEBI).

In January, SEBI allowed mutual funds to launch gold-backed schemes in a country which has a vibrant physical market fueled by tradition.

UTI Asset Management Co Pvt. Ltd. had also said it would launch an exchange-traded gold fund. - source

Rhodium Price ?

See this story : Zimbabwe Jan-April gold output tumbles by a third

MUMBAI (Reuters) - Benchmark Asset Management Co. Pvt. Ltd. on Friday filed papers with India's market regulator for approval to launch an exchange-traded gold fund.

In its initial offer document, Benchmark said the fund would track the domestic prices by investing in physical gold.

Each unit of 'Gold Benchmark Exchange-Traded Scheme' would be equal to the price of one gram gold.

The unit would have a face-value of 100 rupees and priced around the value of gold, Benchmark said in a document filed with Securities and Exchange Board of India. (SEBI).

In January, SEBI allowed mutual funds to launch gold-backed schemes in a country which has a vibrant physical market fueled by tradition.

UTI Asset Management Co Pvt. Ltd. had also said it would launch an exchange-traded gold fund. - source

Rhodium Price ?

Thursday, April 27, 2006

XAU , XAG - Chart Update

The U$D price of Gold broke out of the short term triangle pattern and the initial price target is 671$. The price of gold made higher low then higher high - positive sign. Retesting of the triangle is probable, support resistance at appropriate Fibonacci numbers, trend lines, check the 10 day EMA (240 hour EMA).

The price of silver is showing more weakness on the downside which is very rational since silver is a much smaller market and volatile compared to gold. However, single digit silver price is probably long term history and that’s enormous achievement in itself – price perspective.

Interesting gold market news coming from India:

Banks hoard gold on hopes of higher retail sales

TIMES NEWS NETWORK[ THURSDAY, APRIL 27, 2006 02:41:38 AM]

MUMBAI: Banks are building up large positions in gold in anticipation of record sales of gold coins to retail buyers during the Hindu festival of Akshay Tritiya.

Among public sector banks, Corporation Bank has imported 10,000 specially-minted centenary coins of 8 gms, a large number of which it expects to sell next Sunday.

Indian Overseas Bank launched its retail gold scheme lask week to catch the Akshay Tritiya rush. ICICI Bank, which is one of the biggest retailers of gold in India, has decided to keep its branches open on Sunday, when they are normally closed. HDFC Bank is selling 5gm ‘Mudra’ bars at 298 branches across the country, offering discounts to customers.

Sale of gold by banks was recommended as a stepping stone to capital account convertibility by the Reserve Bank of India committee. Banks were allowed to freely import gold and sell them to the general public. source

See this link regarding the gold market of Iran:

http://www.lbma.org.uk/publications/alchemist/alch42_iran.pdf

Click on the charts below to enlarge :

Copper HG charts

The price of silver is showing more weakness on the downside which is very rational since silver is a much smaller market and volatile compared to gold. However, single digit silver price is probably long term history and that’s enormous achievement in itself – price perspective.

Interesting gold market news coming from India:

Banks hoard gold on hopes of higher retail sales

TIMES NEWS NETWORK[ THURSDAY, APRIL 27, 2006 02:41:38 AM]

MUMBAI: Banks are building up large positions in gold in anticipation of record sales of gold coins to retail buyers during the Hindu festival of Akshay Tritiya.

Among public sector banks, Corporation Bank has imported 10,000 specially-minted centenary coins of 8 gms, a large number of which it expects to sell next Sunday.

Indian Overseas Bank launched its retail gold scheme lask week to catch the Akshay Tritiya rush. ICICI Bank, which is one of the biggest retailers of gold in India, has decided to keep its branches open on Sunday, when they are normally closed. HDFC Bank is selling 5gm ‘Mudra’ bars at 298 branches across the country, offering discounts to customers.

Sale of gold by banks was recommended as a stepping stone to capital account convertibility by the Reserve Bank of India committee. Banks were allowed to freely import gold and sell them to the general public. source

See this link regarding the gold market of Iran:

http://www.lbma.org.uk/publications/alchemist/alch42_iran.pdf

Click on the charts below to enlarge :

Copper HG charts

Friday, February 17, 2006

India Gold mutual funds

First China, now India.

ASHISH GUPTA

TIMES NEWS NETWORK[ FRIDAY, FEBRUARY 17, 2006 12:22:33 AM]

Gold mutual funds may soon be a reality in India. Securities and Exchange Board of India (SEBI) has cleared the way for introducing gold exchange traded funds (ETF) in the country.

It has approved two models for launching the product – a mutual fund custodian bank integrated model and mutual fund warehouse receipt model. These two models were earlier recommended by a SEBI-appointed committee.

Under the mutual fund custodian bank integrated model, the physical gold will be held by a custodian bank on behalf of the mutual fund. The mutual fund sells or buys units to a wholesale intermediary based on the value of the gold with the custodian bank. These units will then be traded on stock exchanges and retail investors could buy them from the wholesale intermediary.

As against this, in case of the mutual fund warehouse receipt model, gold warehouse receipts are held by a custodian bank on behalf of the mutual fund. The mutual fund sells or buys units to a wholesale intermediary based on the value of the gold warehouse receipts with the custodian bank.

Read more @ Source: India times

ASHISH GUPTA

TIMES NEWS NETWORK[ FRIDAY, FEBRUARY 17, 2006 12:22:33 AM]

Gold mutual funds may soon be a reality in India. Securities and Exchange Board of India (SEBI) has cleared the way for introducing gold exchange traded funds (ETF) in the country.

It has approved two models for launching the product – a mutual fund custodian bank integrated model and mutual fund warehouse receipt model. These two models were earlier recommended by a SEBI-appointed committee.

Under the mutual fund custodian bank integrated model, the physical gold will be held by a custodian bank on behalf of the mutual fund. The mutual fund sells or buys units to a wholesale intermediary based on the value of the gold with the custodian bank. These units will then be traded on stock exchanges and retail investors could buy them from the wholesale intermediary.

As against this, in case of the mutual fund warehouse receipt model, gold warehouse receipts are held by a custodian bank on behalf of the mutual fund. The mutual fund sells or buys units to a wholesale intermediary based on the value of the gold warehouse receipts with the custodian bank.

Read more @ Source: India times

Subscribe to:

Posts (Atom)