The USD is looking oversold here and some bounce might be expected. If you add a channel the way I did, you can see that the USD index is at the bottom of the channel. In addition, the USD just tested the psychological important 80 level – this level was rarely violated, ever.

USD Index Daily Chart (note the deep oversold condition of RSI 14)

Try to avoid shorting the Yen as the crowed count this currency as a weak one. The interest rate on the yen is low and might continue to stay low for some time but the Japanese economy is not a weak economy in my book, not at all.

Particular vulnerable is the EURJPY pair which had already completed or might be very near to complete a seven years rally. A large correction is expected here – take note!

EURJPY Weekly Chart , Elliott wave count. (click to enlarge)

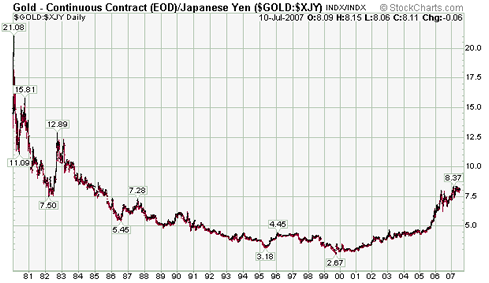

Gold and silver had a nice rally (as expected) but some significant resistance seen for both. on the other hand gold in terms of Yen and Euro made some advance so the move was not all USD related. If the USD will start strengthening as it might gold can correct some of its recent 47$ rally. Corrections should be seen as a buying opportunity and the June low should hold.

Spot Gold weekly chart annotated with Fibonacci levels. (click to enlarge)