Dear readers,

The news which directly or indirectly related to gold are usually subjective and often causing exactly the opposite from what is assumed to be logical (sell the news syndrome). Technicals on the other hand are objective, at least when viewed from numeric perspective.

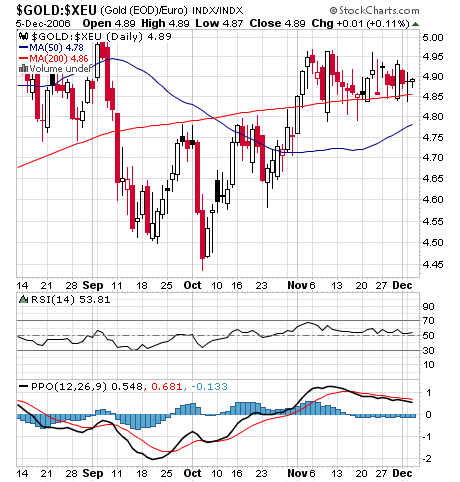

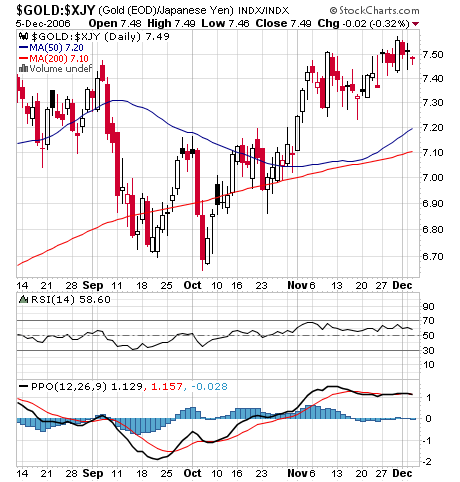

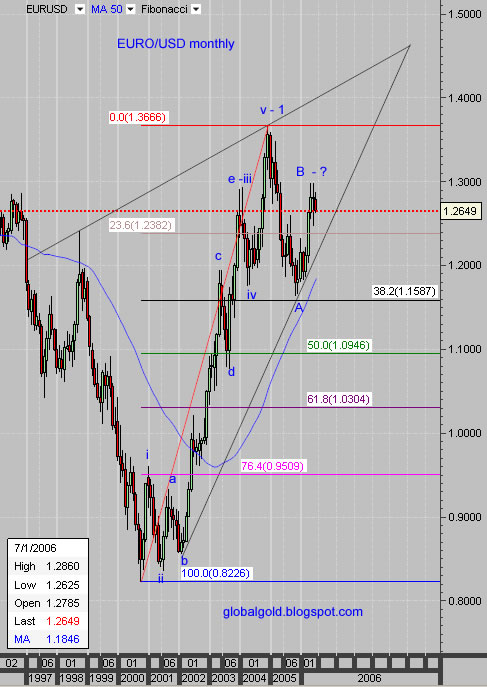

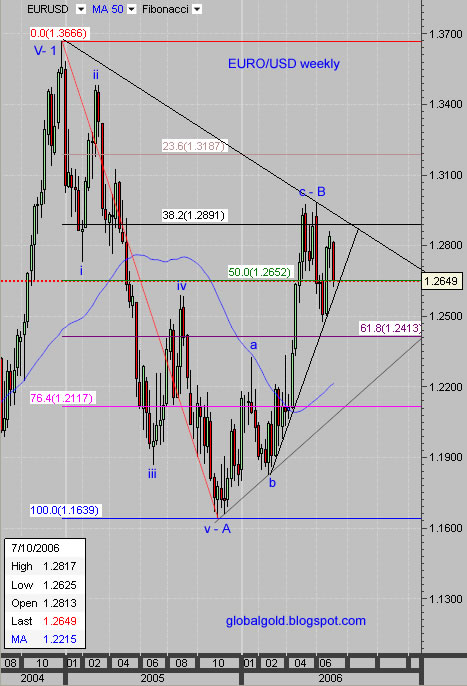

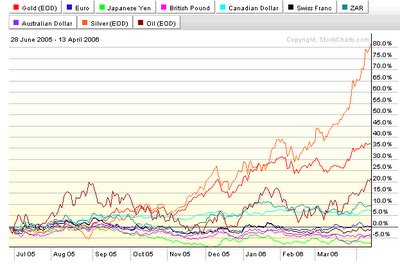

I have prepared three intraday gold charts covering the short term history of Gold/$, Gold/€ & Gold/¥ exchange rates. I added two sets of Fibonacci retracement lines, top to bottom and bottom to top. All three charts are annotated with the same Elliott wave count, high correlation is easily recognized. The pattern similarity between all three charts is indicating that gold is becoming more independent, market factors which used to affect the price of gold (USD index, Euro, Crude Oil. Etc.) are loosing significance. The gold market is evolving to be more mature, the price of gold will be affected by gold market internal forces more then anything else – this is the trend in my opinion. As time goes by and as this great global gold bull market develops, I expect gold influence to grow while gold as a monetary object will be less affected and possibly much less affected by other market variables. Gold and Forex traders should closely observe this development; things that worked in the past might not work in the Future

Gold is completing or already completed its wave (2) – III correction which should be immediately followed by volatile upward movement – wave (3) – III.

I'm repeating the suggested short term bottom target for Gold/$: 613$, 608$ & 593$.

And adding suggested target for Gold/€: 484€ & 471€ and targets for Gold/¥: 71,514¥, 69,361¥ & 68,630¥.

Click on the charts below for better view.

Related:

Gold and Silver StocksFor basic Elliott Wave Tutorial see

EWI (needs free registration)