Wednesday, July 04, 2007

Recommended Readings

By Wang Lan (China Daily)

Updated: 2007-07-04 08:51

The beginning of gold trading by individual investors on the Shanghai Gold Exchange (SGE) later this month is expected to provide a welcome alternative at a time of high stock market volatility. -link

RTS Realtime Systems Group Offers Connectivity To Dubai Gold & Commodities Exchange

03/07/07

RTS Realtime Systems Group (RTS), a leading independent software vendor, announced that the firm is now offering access to the Dubai Gold & Commodities Exchange (DGCX). The move expands the RTS presence in the Middle East and further strengthens its leadership position in electronic trading software, with thousands of user connections to more than 85 exchanges and liquidity pools throughout the world.

-link

Warehouses to help stabilise gold prices

(03-07-2007)

The International Gold Council this year estimates that demand for gold in Viet Nam could reach 70-80 tonnes. A Brink’s Viet Nam representative, Ben Van Kerkwijk predicts in the short run demand will accelerate. - link

GLOBAL EXODUS FROM THE US DOLLAR IN MOTION by Gary Dorsch -link

The Silver Millionaire By David Morgan - link

Tuesday, June 26, 2007

Gold Market Update

Gold markets structural developments:

Small-Lot Gold Futures

100 gram gold contracts to be issued in China and Japan :

"BEIJING, June 26 -- The Shanghai Gold Exchange will launch individual gold bullion trading nationwide in July by teaming up with Industrial Bank."

-source

"TOCOM hopes to inaugurate the new section, aimed at attracting individual investors with reduced trading risks, on July 9. The basic trading unit will be lowered to 100 grams from one kilogram for the existing gold futures. The per-lot margin will be fixed at 12,000 yen for July compared with 90,000 yen for the existing market. Transactions will be settled with cash, not with physical delivery. The daily price fluctuation range will be initially set at 120 yen, twice as wide as for the existing gold futures."

-source

India Gold ETF's

"Sandesh Kirkire, CEO of Kotak Mahindra AMC:

Q: Can you put into perspective as to how much you would actually be investing in physical gold and how much would be in money markets?

A: I think a significant portion will be in physical gold and very marginal amount will remain in cash and cash equivalents. "

-source

Monday, August 07, 2006

Gold / ($, €, ¥) & Silver – Charts

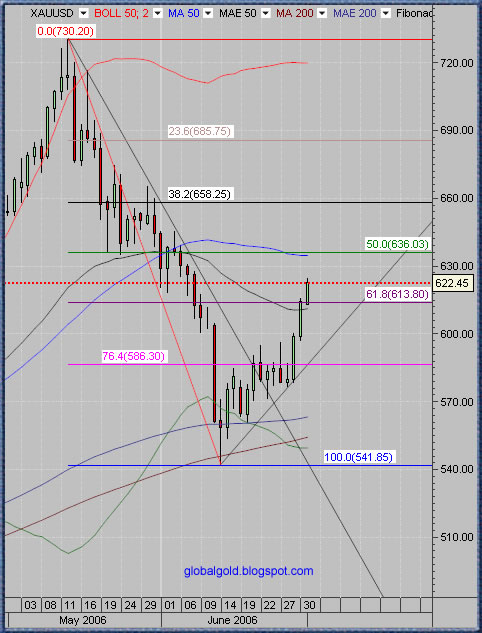

Looking at the 3 month gold charts – gold formed a triangle pattern which is not yet completed. The pattern is similar for Gold/USD, Gold/Euro and Gold/Yen. Silver already broke above its diagonal resistance and consolidates around the 50% Fibonacci line (~12.30$).

It is quiet possible that gold will continue to consolidate around current levels (638$ - 656$) further consolidation is also possible and gold can go as low as 620's (not likely). IF gold can break above the diagonal resistance line, that will ignite a serious rally (I think it can).

As of now, nothing more to report other then:

CBOT (August 4, 2006) system failure - link

China's silver consumption triples

(Xinhua)Updated: 2006-08-07 16:20

China consumed 2,600 tons of silver in 2005, nearly three times the volume of twenty years ago, said sources with the Gemological Association of China.

But the country exports even more than it consumes. With an all-time record production of 7,196 tons of silver in 2005, China has become the world's third biggest silver supplier.

Exports of silver rose to 4000 tons in 2006, up by a third from the 3050 tons notched up in 2004.

Consumption at home surged 190 percent to 2600 tons in 2005 from a modest 900 tons in 1985. Despite the constant fluctuations in the prices of gold and silver on the international market, China's silver consumption has continued to grow steadily in recent years, said the association.-link.

See also:

Gold and Silver Stocks

Commodities Charts

Click on the charts below for enlarged view:

Thursday, August 03, 2006

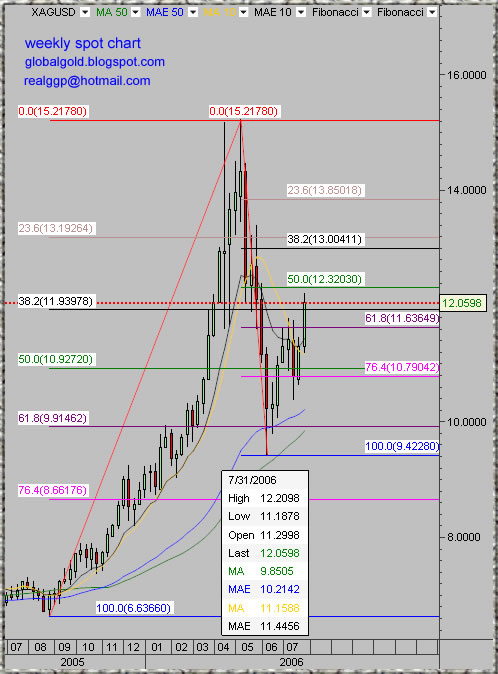

Silver Weekly Chart

China should actively manage 20-30 pct of forex reserves - govt economist

BEIJING (XFN-ASIA) - China should set aside 20-30 pct of its foreign exchange reserves to be actively managed, a government economist said.

Xia Bin, head of the financial research institute within the Development Research Center, a think tank under the State Council, also said that China should increase its holdings of gold 'at the appropriate time.'

He said that the overly rapid accumulation of foreign exchange reserves could imperil management of the economy, and that steps should be taken to put excess reserves to work...- source

Below is a weekly spot silver chart with what I think are very important Fibonacci numbers. If you trade gold and silver then pay attention to this numbers.

Thursday, July 27, 2006

Gold Intraday Chart - Update

Who said gold don’t yield?

Chinese banks step into gold leasing business

Recently, Heraeus Zhaoyuan Precious Metal Materials Co., Ltd. and the Zhaoyuan Branch of China Construction Bank signed an agreement on a gold lease deal of one ton with the lease term of one year.... read more.

Here is a new chart with two channels, the uptrend channel is less steep. Today expected trading range 618$ - 633$.

Click chart to enlarge:

Tuesday, July 04, 2006

Gold and Central Banks

" I like your blog a lot and visit it to see your charts to guess the gold moves. I don't trade futures but interested in buying gold.

But presently, there seem to be no signs that the world will ever move towards a gold standard. The problems of the world itself are so huge to even think of going in that direction. The easier solution is being adopted and everyone is using their printing presses :)

I saw recently that even India increased money supply by 20% this year.

Do you see the gold breaking the 540 support in the next 1 year? The recent jump from support was gr8. I read somewhere that the recent dump, came because the British government decided to sell its gold partly, do you agree to it? "

India is a major power in the global economy particularly in the gold market. As most readers probably know India is the world's largest market for physical gold.

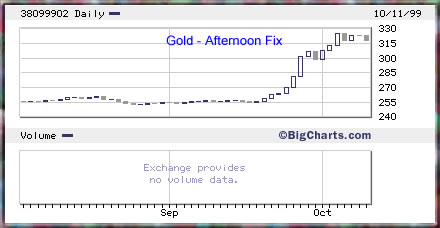

Central Banks are actively participating in the gold market, some as sellers and some as buyers. The European Central Banks have signed several agreements regarding gold selling. The first agreement was signed at September 1999 and ignited a strong rally(see chart below).

The UK signed the first Agreement but not the second (at the time the second Agreement was announced it stated that the UK government has no plans to sell gold).

I did not notice any press release regarding new UK gold sales so I can't agree with rumors. But they can certainly sell secretly (If they got any gold left)

OFFICIAL AGREEMENTS ON GOLD

Other Central Banks like Russia, China and UAE are buying or at least talking about buying gold.

Overall Gold continues to play an important monetary role and its importance is increasing along price - in my opinion. Yes, you are right, currently there is no sign of officially going back to the gold standard. However, one should not rule out a renewed gold standard or something similar.

Mr. Gary Dorsch published an interesting article which shows some interesting relations between global assets prices and gold. I had also posted about this subject and you can freely browse this blog archive.

See also : The importance of the Dow Jones / Gold, Gold / Oil & Gold / Silver ratios

Latest gold market headlines:

China, Raise gold holdings

China should take advantage of any weakness in bullion prices to build up its official gold holdings as part of a strategy for diversifying its foreign exchange reserves, a senior government economist said Monday.

Tuesday, July 04, 2006

China should take advantage of any weakness in bullion prices to build up its official gold holdings as part of a strategy for diversifying its foreign exchange reserves, a senior government economist said Monday.

Xia Bin, head of the financial research institute of the Development Research Center, a think tank under the Cabinet, also proposed that Beijing allow the yuan to fluctuate within a wider range against the dollar.

"It is practical for China to increase its holdings of gold by choosing an appropriate time to buy, because compared with other big trading countries the percentage of gold in China's reserves is seriously low," Xia said in an article on his agency's Web site.

Xia also suggested China establish an international investment fund with the aim of increasing returns from its US$900 billion-plus (HK$7.02 trillion) stockpile of reserves.

Chinese individuals should be permitted to buy into the fund, which would allow them to hold foreign exchange indirectly, he wrote. -source

Bank of Portugal sells 15 tonnes of gold

07/04/06 11:12 am (GMT)

LISBON (AFX) - The Bank of Portugal said it has sold 15 tonnes of gold from its reserves in the last few months.

The bank said the sales were aimed at diversifying its external reserves, with the proceeds to be kept in a special reserve at the central bank.

Last December, the bank sold 10 tonnes of gold.

The sales were carried out as part of the European Central Bank's agreement on gold sales which limits annual gold sales to 500 tonnes up to 2009. -source

Technically the daily chart from two days ago shows a Three White Soldiers - Bullish reversal pattern (high reliability)

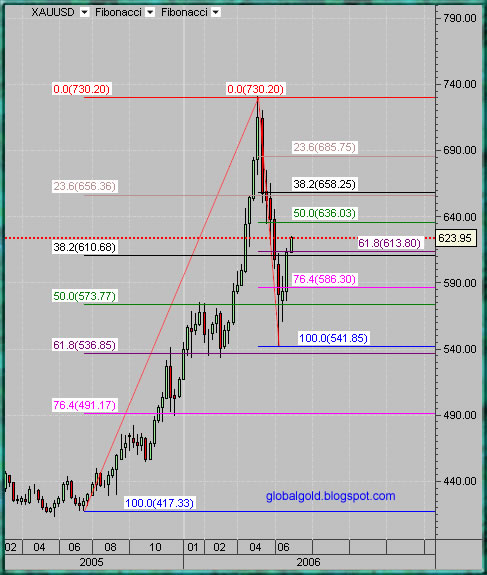

If you look at the weekly spot gold chart below what I see is a relatively good support between the 61.8% fibonnaci line on the short set and the 38.2% on the long set (610$ -613$). If that support doesn’t hold then gold will probably go down to the lower Fibonacci lines (573$ - 586$). Slight resistance around 636$ and more resistance at 656$ - 658$.

Monday, July 03, 2006

XAUUSD Chart, Gold & Silver News

UAE Central Bank set to enter the gold market

The UAE Central Bank Governor this week gave his strongest hint yet that the emirates will shortly enter the gold market and also purchase euros as a diversification of the national currency reserves presently held in US dollars. With the US dollar ripe for devaluation this seems a timely initiative.

The Governor of the UAE Central Bank, Sultan bin Nasser Al Suwaidi told reporters this week that the bank was preparing to convert up to 10 per cent of its currency reserves into gold, although he said that the bank currently held very little gold in its reserves.

'I don't think it is appropriate to buy gold now - it is too expensive. The appropriate time might come very soon. We could go up to 10 per cent,' he said. -source

Shanghai Gold Exchange is about to introduce silver trading for the first time

The regulatory framework for trading silver contracts will be completed as early as next month, said Tong Gang, the exchange's spokesperson.

The launch underscores the rapid development of the silver market in China, which is widely regarded as potentially the most important consumer, producer and exporter of the metal.

The exchange, which currently deals with platinum as well as gold, is expected to trade silver spot and spot-deferred contracts.

Spot contracts are ones that require payment at the time of purchase; spot-deferred contracts require payment a few days after the contract has been made.

Silver futures contracts could also be traded on the exchange.

The country's silver consumption, mainly used by electronics and chemical firms, was estimated at 2,600 tons last year. This compares with only 900 tons two decades ago.

The country is also an important producer and exporter of the metal. -source

See Copper TA Update

Below is gold spot daily chart:

Monday, June 26, 2006

Gold , China & India

Call to mix forex reserves

(Shanghai Daily)

Updated: 2006-06-26 10:19

China's bulging foreign-exchange reserves and massive holdings in US treasuries are prompting some economists and researchers to argue the nation should diversify part of its huge reserves into gold and oil.

China should consider buying more gold with its forex reserves to avoid any losses linked to possible devaluation of its US dollar-backed assets, two central bank officials said in a latest research note.

Using some of the forex reserves to buy gold could "maintain and raise the value of China's dollar holdings," Zhao Qingming from the central bank's Financial Research Institute and Luo Bin from its accounting department wrote in a note published in China Money Market this month.

Although it was still unclear whether the comment might signal any policy change by the People's Bank of China, the central bank, it has highlighted a growing concern over mounting risks in forex investments.

China has forex reserves of US$875 billion by the end of the first quarter this year, surpassing Japan's as the world's biggest.

The country now invests around 1.3 percent of its forex reserves in gold, or about 600 tons. That compares with 8,500-odd tons owned by the United States, which accounts for more than 70 percent of that country's forex reserves. -source

Mumbai: With two mutual fund houses planning to launch gold exchange traded funds (GETFs), investors can look forward to invest in a much safer asset class, after being taken on ride in the equity market.

Two Asset Management Companies (AMCs) UTI and Benchmark recently filed their offer documents with market regulator Securities and Exchange Board of India (SEBI) to launch GETFs, which invest in gold as its underlying asset and trades like any other exchange traded fund on the bourses. - source

Friday, June 23, 2006

XAU, XAG Intraday Elliott Waves

More gossip regarding China:

China can convert part of forex reserves to gold - central bank officials

06.22.2006, 09:24 PM

SHANGHAI (XFN-ASIA) - Two central bank officials suggested China can convert part of its foreign exchange reserves to gold holdings to head off risks from the depreciation of the US dollar, state media reported.

Converting part of foreign exchange reserves to gold can protect and increase the reserve assets, the official Shanghai Securities News reported,

citing an article written by Zhao Qinming, an official at the central bank's financial research institution and Luo Bin of its accounting department.

The article was published on the latest edition of China Money - a monthly magazine controlled by the People's Bank of China, the central bank, the paper said. – source

See HUI(potential)buy signals

It will take more time then I previously thought, but both gold and silver will head higher to new highs. I believe that an orderly appreciation in the price of gold and silver is welcomed and shouldn't pose no treat what so ever. – This is my opinion

Here are spot gold and silver intraday charts with Fibonacci lines and the Elliott wave count. Click on the charts below to enlarge:

Sunday, June 18, 2006

Chinese Gold & Silver Exchange to establish 24-hour electronic trading platform

"I hope to launch the 24-hour electronic trading platform as soon as possible so that we can pull back the transactions which are now taking place outside the exchange," said Lee Tak- lun, after being named the newly elected president of the bullion exchange.

Lee said directors are now looking for strategic partners with a background in gold trading, or even with expertise in electronic trading.

The group needs to forge solid partnerships to push forward plans including the introduction of an around- the-clock electronic trading platform and the launching of a gold transactions registry.

It is also aiming at the strengthening of relationships with the People's Bank of China as well as the Shanghai gold exchange, Lee said.

The exchange also proposes to launch a real gold delivery system to boost turnover, he added.

Explaining the low turnover of the bullion exchange, Lee said that since transactions are in Hong Kong dollars, trading is largely local.

As for the proposed gold depository, which is expected to be located at Hong Kong International Airport, the exchange will cooperate with the government to bring it to fruition smoothly, Lee said. - source

Thursday, June 08, 2006

Cash Piles

08.06.2006, 11.28

XIANGGANG, June 8 (Itar-Tass) - - China, Japan, Taiwan and Russia are in the lead in the world in the volume of gold and foreign currency reserves, says a comparable report prepared by the Hong Kong Currency Department on the basis of the latest statistical data from different countries.

Of late, the biggest holder of state foreign currency reserves has been China which has more than 875 billion dollars. Japan, whose reserves were estimated at 864.1 billion dollars at the end of May, occupies the second place. Taiwan, whose reserves are equal 260.9 billion dollars, ranks third, and Russia with reserves of 247.3 billion dollars - - fourth. -source

Tuesday, May 30, 2006

XAU XAG Bullish Bias

Here some gold related news:

Growing over-the-counter gold trading a legal gray area in China

Shanghai. May 30. INTERFAX-CHINA - Many Chinese companies engaging in over-the-counter (OTC) gold trading are operating in legal limbo as current options cannot satisfy demand.

The Shanghai Gold Exchange (SGE) is the only institute authorized by the government to conduct gold trades. Those gold trades can only be carried out among SGE members, including banks and gold refiners and clients.

Many domestic gold investment companies (gold dealers) that are not members of the SGE, directly conduct OTC trades, which are over the telephone or by computer on the overseas markets. -source

MPS want 'online gold trading' to be stopped

(Press Trust of India Via Thomson Dialog NewsEdge)Madurai,May 29 (PTI) A Group of MPs have appealed to the Centre to immediately stop "online gold trading," which they described as "gambling" and "affected marriage of women in middle class families." In a memorandum to the Prime Minister, a copy of which was released to the media here, 12 Mps from Tamil Nadu, West bengal and Kerala said traders across the world were earning crores of rupees through their "monopolistic online trading", and they were mainly responsible for the steep hike in gold prices. -source

Gold is safe to invest in, say experts

Our Regional Bureau / Mumbai/ Ahmedabad May 30, 2006

Gujarat Chamber of Commerce & Industry and H L College Alumni Association, jointly organised a seminar on Current and Future Trends in Capital, Commodity and Metal Markets in city on Sunday.

C Chakrabarty, head of training and R&D, MCX said MCX has grown tremendously with its turnover increasing to Rs 10,000 crore and made an impact on the stock market.

He said gold is a safe commodity, high liquidity asset and also an international currency having world wide value acceptance. source

Charts below clickable:

Friday, May 19, 2006

To melt or not to melt: That's the coin question...

2006/5/19

The China Post staff

To melt or not to melt: That's the question.

Well, it's the question of the day.

What to melt?

Small coins, of course, now that the prices of copper, nickel and aluminum have soared just as gold and silver did.

Whether the melting has started in Taiwan on a scale large enough to cash in on the surge of metal prices is not known, but non-numismatist entrepreneurs certainly are looking into the possibilities of amassing a trove of small change to make the quick buck.

With the gold price hitting US$700 an ounce, one kilogram of lowly nickel can fetch close to ten pounds sterling -- 9 pounds 45.7 pence to be exact -- in London, where the same weight of once cheap copper is sold at three pounds 89.6 pence.

Ubiquitous aluminum? One pound 35 pence a kilo.

That makes it lucrative to get hold of at least one million NT$1 coins, melt them and sell them as ingots, according to an enterprising newly converted numismatist.

"You spend only NT$1 million," says the entrepreneur. "And you get NT$1.26 million."

But he doesn't say he has set up shop.

It's much better to melt half-dollar NT coins, he adds.

They are a little smaller in size than the NT$1 coins, but a half-dollar melted is worth NT$0.93 or 43 cents more than its par value.

The reason is that you have to have at least 3.8 metric tons of change to make your melting business go. You spend much less to get that much if you collect only half-dollars.

That is not quite right, the Central Bank of China points out.

For one thing, it's against the law.

Anyone found to have purposely destroyed the legal tender shall be sentenced to not over one year but not less than seven years in prison, the law says.

Moreover, a Central Bank expert says, it's not profitable at all to melt and sell.

The expert continues copper accounts for 92 percent of the 3.8 tons of NT$1 coins. They contain 6 percent of nickel and 2 percent of aluminum.

"In other words," the Central Bank official goes on, "there will be 3.496 tons of copper, 228 kilograms of nickel and 76 kilograms of aluminum."

Sold on the London market, they would bring in only NT$952,738. The breakdown is NT$817,225 for copper, NT$129,371 for nickel, and NT$6,142 for aluminum.

The net loss is NT$47,262. If freight is added, the loss will be even greater.

Wait a minute, the entrepreneur says.

"He may be right," the enterprising numismatist adds, "but you will do much, much better, if you collect the old NT$1 coins."

The old coin, known as the plum change for the flower on the back side, is no longer in use as the legal tender. "You don't have to worry about the long arm of the law," he adds.

It's heavier, six grams against only 3.8 grams of the coin in circulation.

As a result, NT$1 million worth of plum coins weigh up to six metric tons, of which 3.3 tons are copper. There are 1.08 tons of nickel and 1.62 tons of aluminum.

Altogether NT$1,904,164 will be made by getting NT$1 million worth of plum coins, melt them and sell them in ingots in London.

And there's a historical precedent.

In 1973, copper and nickel prices soared, and so many plum coins were melted and sold in ingots in Taiwan that an acute shortage of change resulted.

Butchers and grocers in Taipei came up with a clever way to make up for the shortage of change they have to give back to overpaying customers.

They printed their NT$1 IOUs. Their customers gladly accepted them. - source

Wednesday, May 10, 2006

China Gold reserves

Beijing whispers push gold to $700By Ambrose Evans-Pritchard (Filed: 10/05/2006)

Gold has surged to $700 an ounce for the first time in 26 years after Chinese economists suggested the country should quadruple its bullion reserves to protect against a falling dollar.

Speculators have been alert to any sign that Beijing may be planning to switch a portion of its massive $875bn reserves into gold, a move that would electrify the market.

They seized on comments yesterday by Liu Shanen, an official at the Beijing Gold Economy Development Research Centre, who said China should raise the portion of gold in its reserves from 1.3pc today to between 3pc and 5pc. Such a move would entail the purchase of 1,900 tonnes of gold, equivalent to gobbling up nine months of global mine production.

Washington's cold response to Iran's move to defuse nuclear tension also helped fuel yesterday's rally. "No one is buying Iran's overtures," said Frank McGhee, a metals trader at Integrated Brokerage Services. "This is a purely geo-political move for gold. We've been here before. The difference is that this time, there are nukes involved."

June gold futures jumped $20.10 an ounce in New York, briefly touching the $700 line before falling back slightly.

Tan Yaling, an economist at the Bank of China, backed the call for higher gold reserves to "help the government prevent risks and handle emergencies in case of future possible turbulence in the international political and economic situation".

John Reade, a UBS analyst, said neither economist had any official role but hints were enough to drive prices in the current climate. "This is an investor frenzy, and China has become the biggest rumour in the gold world right now," he said.

Mr Reade said gold had changed stride since the middle of last year, the key moment when it broke out against all major currencies and began to attract investment from the big money brigade.

"Speculative and investment interest has replaced jewellery demand. The last time that happened was in 1979 to 1980," he said.

He said it was likely that Middle Eastern investors were switching petrodollars into gold after burning their fingers in local stock markets.

Ross Norman, director of the BullionDesk.com, said China may already be a silent buyer on the open market.

Central banks are supposed to record their gold purchases with the IMF promptly, but they have been known to move stealthily for months before declaring.

"This market has been bouncing back so quickly after each bout of profit-taking that it looks as if somebody big is trying to get in. It's too darn hot for my liking," he said.

Mr Norman said there was a fair chance that gold mining equities would start to play "catch-up". -source

Monday, March 27, 2006

Gold and Silver news

As I posted a several time in the past: each and every self respected exchange will soon offer gold and silver trading / saving instruments. Here are some of the important news which directly effect gold and silver:

Dubai commodity bourse to begin silver futures trading today

Dubai: The DGCX Silver Futures Contracts, to be launched today, will be a 1,000 troy ounce contract with maturities in March, July, September and December each year.

On maturity of a futures contract, the open position would be settled through delivery of 30 kg silver bars from 10 approved brands complying with Dubai Good Delivery standards. source

Taiwan gold futures end firmer on first day

TAIPEI (Reuters) - Taiwan's first gold futures contract closed firmer on the first day of trade on Monday, with investors watching to see if volumes would be high enough to attract continued interest.

The most active June contract closed at US$564.1 per ounce, off an intraday peak of $572.2, but up from an open of $550.0 an ounce on volume of 278 lots. source

It is extremely bullish when a multi bullion guaranteed free cash flow entity (like the CB of china) has a buying interest in your saving asset :

China should tap FX reserves to buy gold

BEIJING, March 27 (Reuters) - China should use part of its fast-growing foreign exchange reserves to buy gold as it seeks to adjust the asset mix to hedge against risk, a Bank of China official was quoted on Monday as saying.

Analysts say China has been gradually diversifying away from the dollar -- although fears of a collapse in the U.S. currency will prevent any dramatic shift. Chinese officials have denied reports they plan to sell current dollar assets in the reserves.

"China should appropriately reduce the proportion of dollars in its foreign exchange reserves while increasing the proportion of currencies such as the euro," the Financial News quoted Wang Yuanlong, a director at Bank of China's Australian operations, as saying.

"We can use part of the foreign exchange reserves to buy gold, which would help make the reserves more diversified and help guarantee and increase their value," said Wang, former economist at Bank of China, the country's largest foreign exchange bank.

China's foreign exchange reserves swelled 34 percent in 2005 to a record $818.9 billion, but the central bank has not disclosed the composition. source

Tuesday, March 14, 2006

Silver , China and Swiss.

Meanwhile on the silver front :

Shanghai Gold Exchange is preparing to start silver trade, which will set the benchmark for Chinese prices, industry sources said on Friday. The new product could increase China's investment demand for silver and reduce its exports, they said. China exports about two-thirds of its silver production.

For anyone who is looking for Free real time quotes for the futures, stocks and Forex markets. I suggest you checkout ADVFN:FREE Real Time Quotes

I also suggest trying this interesting trading software which is based on AI ( Neural Network),Download TradingSolutions

I have annotated a daily chart of spot silver with Elliot wave count and trend lines, click on the chart below to enlarge:

Wednesday, March 01, 2006

Gold in Euro and China...

The price target should be ~493 Euro per one gold OZ.

Click on the chart below to enlarge:

China Leads From The Front By Doubling Its Gold Reserves This Year

Interesting to read that the National Development and Reform Commission has stated that China intends to more than double its gold reserves to 1,270 tonnes this year. According to figures released recently by the World Gold Council on official gold holdings this will put it on a par with Switzerland in 6th position. In 2005 China increased its gold reserves by 20 per cent to 620 tonnes and now it is going to add a further 650 tonnes. Down at the bottom of the list, or very close to it, is the poor old UK with a paltry 311.2 tonnes thanks to the devious machinations of Chancellor Brown. On one side is Venezuela and just below is Belgium – not the usual place for a once proud empire. And what about Australia, Canada and South Africa, the three countries which traditionally prided themselves on their mining. None of them feature in the Top Twenty gold holders.

China still has some way to go to catch up with the US which is said to have 8,133.5 tonnes of gold stored in Fort Knox. The word ‘said’ is introduced deliberately as the gold depository at Fort Knox is a classified facility. No visitors are permitted, and no exceptions are made. Back in the 1970s a man named Edward Durrell claimed that substantially all of the US Gold Reserve being stored at Fort Knox had gone. A modest amount remained, but the rest had been shipped to London in 1967 and early 1968 for sale by President Johnson in an ill-fated attempt to keep the price of gold at US$35 per ounce. Since then there have been variations on this story and the sad thing now is that the US government retains so little credibility that no one knows what to believe. source

Tuesday, February 14, 2006

Gold charts

I have already explained a lot about the main drivers behind the price of gold, so please review the archive for more information.

China hungry for gold

14:25:23 GMT, 14 February, 2006

Shanghai Gold Exchange president Wang Zhe believes that China could become one of the world's biggest gold importers.

The country's gold trading volume increased by 36 per cent in 2005, and Mr Zhe said China "has the potential to be one of the biggest gold markets in the world," according to the Financial Times.

His views are supported by recent consumer spending in the world's most populous country.

The Old Phoenix jewellery store in Shanghai has been selling a large number of $2,000 gold bars embossed with the Beijing Olympics logo.

A salesman said that "there will be a new bar every year until 2008 and many people want the complete set".

The situation is vastly different from even a few years ago – up to 1982, individuals in the country were not allowed to own gold.

However, the country is now poised to become a significant gold importer.

"Commodities will have a strong investment case in the year ahead because of the strong Asian growth," said Michael Hartnett of Merrill Lynch.

Gold in particular has a strong case as global growth gains momentum in the second half of 2006. source: World Gold Council www.gold.org

Click on the annotated charts below to enlarge:

Monday, February 06, 2006

China's first gold fund may be created

2006-02-07 Beijing Time

THE China Gold Association is considering forming the country's first gold fund with partners.

"Some association members have discussed the program to start a gold fund to tap China's gold market," Hou Huimin, vice chairman of the Beijing-based association, said via telephone yesterday. "It's still only a proposal at this stage and we have not yet contacted banks or gold companies about further moves."

The fund will exceed 1 billion yuan (US$124 million) if it is raised, he said, dismissing a previous media report that the fund would be between 500 million and 1 billion yuan.

He declined to provide a timetable or other details.

Gold's investment allure is strong as the central government has opened the individual gold investment sector with more products.

Read more...

Thursday, February 02, 2006

Gold and Silver four hours charts

Click on the charts below to enlarge

commodities charts: Palladium Futures (PA, NYMEX)