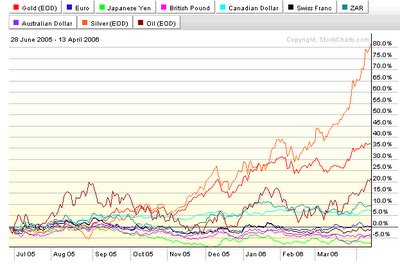

Here is a performance comparison 200 day chart between several popular national currencies, Gold, Silver and OIL. Looking at the chart it is very easy to notice that almost all national currencies are actually down to unchanged against the USD (200 days time frame) the exceptions are the South African Rand (ZAR) and the Canadian Dollar – both are gold, silver & commodity rich nations.

The conclusion is this: Under current market conditions it is a possibility that the USD will continue to stay relatively unchanged vs. other national currencies. Regardless of the country you are living in, gold and silver savings have been profitable the last 200 days. Investors who look for currency diversification should look at gold (with a glance of silver) and ignore the minor fluctuation in the Forex market.

No comments:

Post a Comment