I just noticed that the Bank of International settlements (BIS) have published a new paper on over the counter derivatives including gold and other commodities. I will study the report and publish my thoughts and conclusions. You can see my thoughts on the previous BIS OTC report here :

http://globalgold.blogspot.com/2005/12/great-gold-paradox-part-ii.html

Here is a link for June 2006 BIS OTC report

http://www.bis.org/statistics/derstats.htm

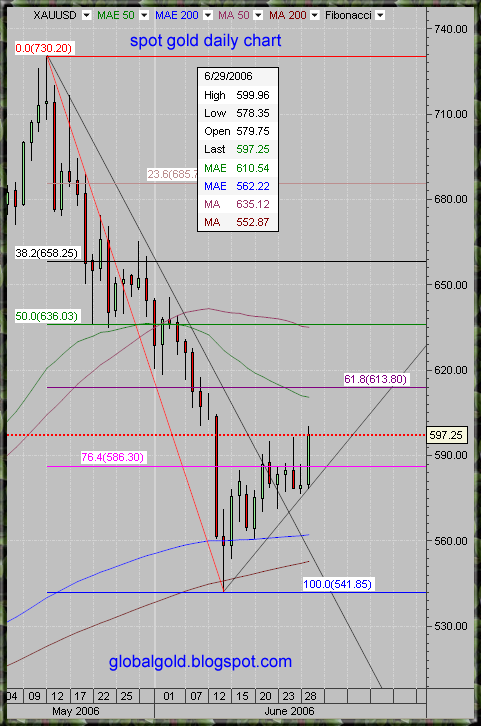

In my opinion gold is headed higher to new highs but it will have to struggle with resistance and profit taking along the way. Traders should concentrate on carefully buying bottoms and taking partial profits along the way. Gold is again above the 76.4% Fibonacci line which should provide good support for any impending pullback.

You can contact me regarding any issue - Email

3 comments:

A new buy signal on GLD has been signaled at decisionpoint.com, so I am now bullish on the short, intermediate and long term trend. It also looks like $550 is going to hold as chart support. As a interesting sidenote, the $500 to $550 range used to be chart resistance.

Here is some more commentary to read at goldmoney.com:

[Link]

And there is a nice chart in this link that shows the $500 resistance level.

[Link]

Thanks B.W

Goldmoney - interesting concept, growing business?

Yeah, Goldmoney definitely seems to be a growing business. I also would not be surprised to see greater inflows of money into the new trusts such as GLD and SLV in the near future.

Very Respectfully,

bubble_watcher

Post a Comment