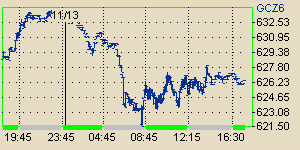

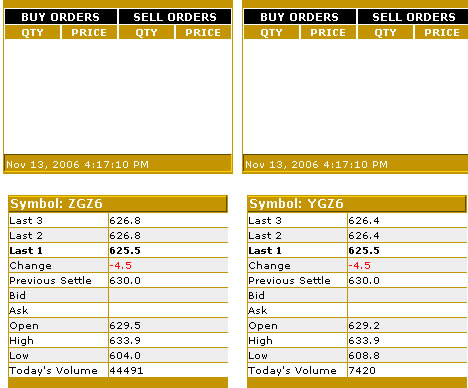

At the same time NYMEX – COMEX gold contract (GC) was quoted not lower then 621$, The Inter bank and over the counter markets where divided, some followed Cbot while other followed the Comex. All contracts mentioned are December 2006 and spot prices for OTC and Inter bank markets.

Here is what Bloomberg have to report about the issue:

Gold also fell after the sale of the metal in Chicago at a price below the market caused speculators to reduce their holdings.

Gold dropped as much as $26, or 4.1 percent, in electronic trading on the Chicago Board of Trade, to $604 an ounce. The metal in London was trading at the same time at around $625. An estimated 100,000 ounces were sold in Chicago, triggering preset sell orders, said Martyn Whitehead, director of commodity sales at Barclays Capital in London.

``It became a cascade of stop-loss orders, which caused the fairly large $20 gap we saw in the market this morning,'' said Whitehead, who is also vice chairman of the London Bullion Market Association, which runs the gold market in London. ``Someone, somewhere lost a bit of money this morning.''

Prices rebounded before the Comex opening.

``The whole break took about 20 seconds,'' McGhee of Integrated Brokerage said.

Prices May Rebound

Gold may rebound, Perez-Santalla said. ``The gold market didn't drop,'' he said. ``CBOT dropped. Anybody who had stop losses got hurt. It'll remind people of the sensitivities of electronic trading.''

CBOT has captured about 49 percent of the gold-futures market after two years of electronic trading. The exchange last week began open-auction trading on gold and silver contracts to trade side-by- side with its electronic trading platform.

``You have much more of a feel for the market when you're using the floor instead of the screen,'' said Nick Ruggiero, a trader at Eagle Futures Inc. in New York.

Craig Grabiner, a spokesman for CBOT, said he couldn't comment immediately.

-source

Technically it will be logical to assume that gold is retracing some of its 77$ recent move up .

No comments:

Post a Comment