By Summer Said

DUBAI (Reuters) - Dubai, already the region's gold trade hub, may see the launch of the Middle East's first gold exchange traded fund (ETF) in 2008, a senior World Gold Council (WGC) official said on Monday.

"Gold trade in Dubai and the region is definitely booming and the market players need an ETF market to manage their risk and catch up with other international markets," said Moaz Barakat, managing director of the WGC in the Middle East, Turkey and Pakistan.

"There is a great interest for ETFs in the region... We may have a Dubai ETF next year."

ETFs offer investors exposure in the underlying commodity without taking physical delivery. Sponsors of gold ETFs buy a matching amount of the commodity from the market to keep in vaults.

"It will be linked to a dollar-based gold price, but it has not been decided yet if it will be listed on the Dubai Gold and Commodities Exchange or the Dubai International Finance Exchange," he said.

source

Tuesday, July 31, 2007

Tuesday, July 24, 2007

GCQ7 Update

Dear readers,

This will probably be the last GCQ7 chart as gold futures contracts are rolled into December and October (GCV7, GCZ7).

Hype is all over the place so sentiment indicator probably supports the case for some correction here, As previously mentioned USD is trying to bounce.

August Gold - GCQ7 Intraday (120 min) Chart

This will probably be the last GCQ7 chart as gold futures contracts are rolled into December and October (GCV7, GCZ7).

Hype is all over the place so sentiment indicator probably supports the case for some correction here, As previously mentioned USD is trying to bounce.

August Gold - GCQ7 Intraday (120 min) Chart

Sunday, July 22, 2007

Gold, USD & Forex Update

Dear readers,

The USD is looking oversold here and some bounce might be expected. If you add a channel the way I did, you can see that the USD index is at the bottom of the channel. In addition, the USD just tested the psychological important 80 level – this level was rarely violated, ever.

USD Index Daily Chart (note the deep oversold condition of RSI 14)

Try to avoid shorting the Yen as the crowed count this currency as a weak one. The interest rate on the yen is low and might continue to stay low for some time but the Japanese economy is not a weak economy in my book, not at all.

Particular vulnerable is the EURJPY pair which had already completed or might be very near to complete a seven years rally. A large correction is expected here – take note!

EURJPY Weekly Chart , Elliott wave count. (click to enlarge)

Gold and silver had a nice rally (as expected) but some significant resistance seen for both. on the other hand gold in terms of Yen and Euro made some advance so the move was not all USD related. If the USD will start strengthening as it might gold can correct some of its recent 47$ rally. Corrections should be seen as a buying opportunity and the June low should hold.

Spot Gold weekly chart annotated with Fibonacci levels. (click to enlarge)

The USD is looking oversold here and some bounce might be expected. If you add a channel the way I did, you can see that the USD index is at the bottom of the channel. In addition, the USD just tested the psychological important 80 level – this level was rarely violated, ever.

USD Index Daily Chart (note the deep oversold condition of RSI 14)

Try to avoid shorting the Yen as the crowed count this currency as a weak one. The interest rate on the yen is low and might continue to stay low for some time but the Japanese economy is not a weak economy in my book, not at all.

Particular vulnerable is the EURJPY pair which had already completed or might be very near to complete a seven years rally. A large correction is expected here – take note!

EURJPY Weekly Chart , Elliott wave count. (click to enlarge)

Gold and silver had a nice rally (as expected) but some significant resistance seen for both. on the other hand gold in terms of Yen and Euro made some advance so the move was not all USD related. If the USD will start strengthening as it might gold can correct some of its recent 47$ rally. Corrections should be seen as a buying opportunity and the June low should hold.

Spot Gold weekly chart annotated with Fibonacci levels. (click to enlarge)

Tuesday, July 17, 2007

Gold and Silver Charts

Gold Market News

First Japanese gold ETF due to launch Aug. 10

source

As well as Small-Lot Gold Futures Trading on TOCOM(100 grams per lot , margin = 12,000 Yen)

source

Korea : The government plans to establish an exchange for gold as early as next year.

By Lee Hyo-sik

Staff Reporter

"The government plans to establish an exchange for gold as early as next year to make gold transactions more transparent and discourage the smuggling of the precious metal.

According to the Ministry of Finance and Economy, the government will set up an exchange, an organization to manage and supervise gold distribution, next year to stem any illegal transactions and distribution of gold.

It will expand the exchange into a comprehensive commodity exchange, like New York Mercantile Exchange (NYMEX), to deal with not only gold, but diamond, crude oil and other commodities as well.

The exchange will operate separately from the Korea Exchange (KRX) on which stocks, bonds and derivatives are traded, the ministry said."

source

source

As well as Small-Lot Gold Futures Trading on TOCOM(100 grams per lot , margin = 12,000 Yen)

source

Korea : The government plans to establish an exchange for gold as early as next year.

By Lee Hyo-sik

Staff Reporter

"The government plans to establish an exchange for gold as early as next year to make gold transactions more transparent and discourage the smuggling of the precious metal.

According to the Ministry of Finance and Economy, the government will set up an exchange, an organization to manage and supervise gold distribution, next year to stem any illegal transactions and distribution of gold.

It will expand the exchange into a comprehensive commodity exchange, like New York Mercantile Exchange (NYMEX), to deal with not only gold, but diamond, crude oil and other commodities as well.

The exchange will operate separately from the Korea Exchange (KRX) on which stocks, bonds and derivatives are traded, the ministry said."

source

Thursday, July 12, 2007

GCQ7

Gold, Silver, Platinum & Palladium all up on the day.

Two hours sticks chart of COMEX August gold contract looking very similar to the COMEX September silver chart I posted two days ago.

Two hours sticks chart of COMEX August gold contract looking very similar to the COMEX September silver chart I posted two days ago.

Wednesday, July 11, 2007

Japan Should Diversify Reserves

Markets normally lead the press…

Japan Should Diversify Reserves, Abe Adviser Ito Says

By Shigeki Nozawa

July 11 (Bloomberg) -- Japan, the largest overseas holder of U.S. Treasuries, should invest $700 billion of its currency reserves in higher-yielding assets such as stocks and corporate bonds, said Takatoshi Ito, an adviser to the prime minister.

The reserves should be managed by a special fund that will gradually diversify into euros, Australian dollars and emerging- market currencies, Ito said in an interview in Tokyo.

Central banks in South Korea, China and Taiwan have announced plans to buy assets with higher returns than U.S. debt, contributing to a 7.4 percent drop in the dollar against the euro in the past year. -source

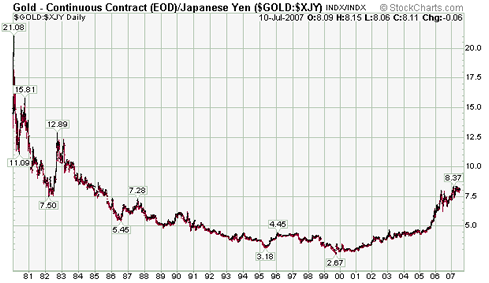

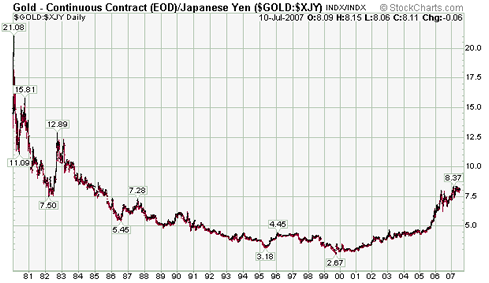

Long term 27 years Gold / Yen Chart (XAUJPY) Price scale : 10K Yen per Gold Troy Ounce.

Japan Should Diversify Reserves, Abe Adviser Ito Says

By Shigeki Nozawa

July 11 (Bloomberg) -- Japan, the largest overseas holder of U.S. Treasuries, should invest $700 billion of its currency reserves in higher-yielding assets such as stocks and corporate bonds, said Takatoshi Ito, an adviser to the prime minister.

The reserves should be managed by a special fund that will gradually diversify into euros, Australian dollars and emerging- market currencies, Ito said in an interview in Tokyo.

Central banks in South Korea, China and Taiwan have announced plans to buy assets with higher returns than U.S. debt, contributing to a 7.4 percent drop in the dollar against the euro in the past year. -source

Long term 27 years Gold / Yen Chart (XAUJPY) Price scale : 10K Yen per Gold Troy Ounce.

Tuesday, July 10, 2007

XAU, XAG & Forex Commentary

Not much change in the USD price of gold (xauusd) today. Gold futures traded and closed slightly higher but priced in Euro and Yen gold is actually down today.

The Euro made a new all time high vs. the USD, EURUSD ~= 1.3740. Note that pre issued Euro high was EURUSD 1.4750, Long term (30 years) retro perspective EUR/USD chart.

Marginal carry traders capitulated as the Yen rallied strongly. Be careful with that one! , Seems like the carry trade become way over crowded as every one and his dog doing the thing.

Silver up, the high of the day was 13.085 for SIU7 (COMEX September contract)

Silver SIU7 Intraday Chart (2 hours sticks)

The Euro made a new all time high vs. the USD, EURUSD ~= 1.3740. Note that pre issued Euro high was EURUSD 1.4750, Long term (30 years) retro perspective EUR/USD chart.

Marginal carry traders capitulated as the Yen rallied strongly. Be careful with that one! , Seems like the carry trade become way over crowded as every one and his dog doing the thing.

Silver up, the high of the day was 13.085 for SIU7 (COMEX September contract)

Silver SIU7 Intraday Chart (2 hours sticks)

Monday, July 09, 2007

It Is What It Is.

It is always nice to see the price of gold performing well on a day when other currencies are basically idle. The price of gold climbed through several horizontal and diagonal resistance levels, the process was very quick. Gold charts of multiple time frames are now looking much better. Today just proves that buy and hold can work on some occasions, especially when quick mark ups are expected.

If you followed my posts you should know what my expectation is and there is not much more to add at this point.

Here is an example for one of the positive developments taking place:

Not perfect but this semi inverted head and shoulders pattern has a target of 677$.

Gold Spot (XAUUSD) Intra Day (four hours sticks) Chart

If you followed my posts you should know what my expectation is and there is not much more to add at this point.

Here is an example for one of the positive developments taking place:

Not perfect but this semi inverted head and shoulders pattern has a target of 677$.

Gold Spot (XAUUSD) Intra Day (four hours sticks) Chart

Saturday, July 07, 2007

XAGUSD Chart

Some initial upward movement for the price of gold and silver. Not surprising as buy signal was generated by the HUI/GOLD ratio. Silver outperformed and closed at the high for the week. A slight uptrend is apparent on the intraday chart. As you probably know all trend lines are made to be broken and the shorter the time frame the larger the chance that a trend line will be broken. Anyway, markets moves are not linear, markets moves in waves or more precisely fractal waves.

Spot Silver intraday 2 hours chart.

Spot Silver intraday 2 hours chart.

Thursday, July 05, 2007

Quick Update

Dear readers,

It is a given fact that gold reached a technical comfort zone. I find it funny to read commentary with price objectives slightly above, at or below gold mining break even point. It is a mystery how low the price of gold can be manipulated in a mission to hide competitive currencies devaluation on a global scale.

All charts and ratios considered I estimate that a volatile markup for the price of gold and silver should soon follow.

It is a given fact that gold reached a technical comfort zone. I find it funny to read commentary with price objectives slightly above, at or below gold mining break even point. It is a mystery how low the price of gold can be manipulated in a mission to hide competitive currencies devaluation on a global scale.

All charts and ratios considered I estimate that a volatile markup for the price of gold and silver should soon follow.

Wednesday, July 04, 2007

Recommended Readings

Individual gold trade this month

By Wang Lan (China Daily)

Updated: 2007-07-04 08:51

The beginning of gold trading by individual investors on the Shanghai Gold Exchange (SGE) later this month is expected to provide a welcome alternative at a time of high stock market volatility. -link

RTS Realtime Systems Group Offers Connectivity To Dubai Gold & Commodities Exchange

03/07/07

RTS Realtime Systems Group (RTS), a leading independent software vendor, announced that the firm is now offering access to the Dubai Gold & Commodities Exchange (DGCX). The move expands the RTS presence in the Middle East and further strengthens its leadership position in electronic trading software, with thousands of user connections to more than 85 exchanges and liquidity pools throughout the world.

-link

Warehouses to help stabilise gold prices

(03-07-2007)

The International Gold Council this year estimates that demand for gold in Viet Nam could reach 70-80 tonnes. A Brink’s Viet Nam representative, Ben Van Kerkwijk predicts in the short run demand will accelerate. - link

GLOBAL EXODUS FROM THE US DOLLAR IN MOTION by Gary Dorsch -link

The Silver Millionaire By David Morgan - link

By Wang Lan (China Daily)

Updated: 2007-07-04 08:51

The beginning of gold trading by individual investors on the Shanghai Gold Exchange (SGE) later this month is expected to provide a welcome alternative at a time of high stock market volatility. -link

RTS Realtime Systems Group Offers Connectivity To Dubai Gold & Commodities Exchange

03/07/07

RTS Realtime Systems Group (RTS), a leading independent software vendor, announced that the firm is now offering access to the Dubai Gold & Commodities Exchange (DGCX). The move expands the RTS presence in the Middle East and further strengthens its leadership position in electronic trading software, with thousands of user connections to more than 85 exchanges and liquidity pools throughout the world.

-link

Warehouses to help stabilise gold prices

(03-07-2007)

The International Gold Council this year estimates that demand for gold in Viet Nam could reach 70-80 tonnes. A Brink’s Viet Nam representative, Ben Van Kerkwijk predicts in the short run demand will accelerate. - link

GLOBAL EXODUS FROM THE US DOLLAR IN MOTION by Gary Dorsch -link

The Silver Millionaire By David Morgan - link

Monday, July 02, 2007

Positive Reason

Interesting times head as significant adjustments are in the works. Currencies, Silver Gold, Oil, Stocks all in the equation with the most controlled item actually needs to be Interest rates.

Commodities continue to trade with a group and / or individual bias. Generally it might be the case that commodities are the best play as the long term (decades) cycle is probably most favorable for this asset class.

Gold and Silver fundamentals have never been better with global system adjustments seen as a long term positive. Significant amount of shorting taking place and some of it probably un hedged (naked).

Exact timing and finding reasons for the day to day action is tricky.

Commodities continue to trade with a group and / or individual bias. Generally it might be the case that commodities are the best play as the long term (decades) cycle is probably most favorable for this asset class.

Gold and Silver fundamentals have never been better with global system adjustments seen as a long term positive. Significant amount of shorting taking place and some of it probably un hedged (naked).

Exact timing and finding reasons for the day to day action is tricky.

USD Index

Subscribe to:

Posts (Atom)