The price of silver is currently lagging gold and the trend line is less steep – however that can change real quickly. Silver moved up to test the 61.8% Fib which coincide with the 100 DMA. The trend line on the spot silver chart implies new multi years high no later then the end of October.

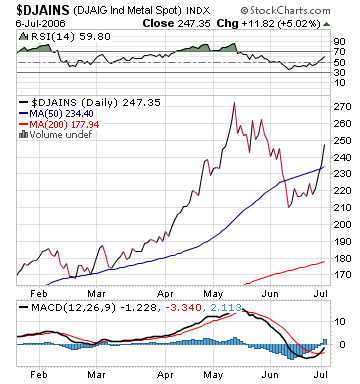

The Dow Jones-AIG Industrial Metals Index (aluminum, copper, zinc and nickel) is up 5% today - outperforming both gold and silver by a wide margin.

No comments:

Post a Comment