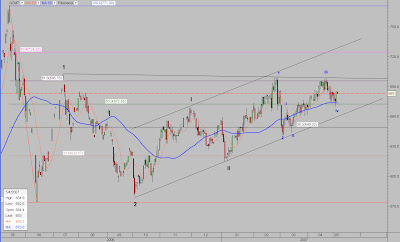

Gold traded between ~893$ and ~934$ which is a 41$ trading range for the week.

Open = 928$ and close 910$, third red candle in a row.

However, gold did not trade below or above any significant low or high.

Cyclical resistance zones: July 15 high of ~988$ and March 17 high (all times high) ~1032.20$.

Cyclical support zones: 12 Jun Low of ~857.45$ May 2 low of ~845.50$.

Pivot zone : ~912$

Currently the most active contract is December gold futures (GCZ8 / ZGZ8 / YGZ8)

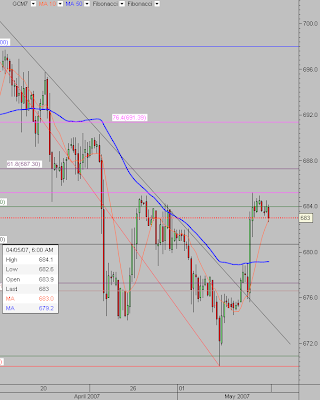

Gold spot 8 hours linear chart