" I like your blog a lot and visit it to see your charts to guess the gold moves. I don't trade futures but interested in buying gold.

But presently, there seem to be no signs that the world will ever move towards a gold standard. The problems of the world itself are so huge to even think of going in that direction. The easier solution is being adopted and everyone is using their printing presses :)

I saw recently that even India increased money supply by 20% this year.

Do you see the gold breaking the 540 support in the next 1 year? The recent jump from support was gr8. I read somewhere that the recent dump, came because the British government decided to sell its gold partly, do you agree to it? "

India is a major power in the global economy particularly in the gold market. As most readers probably know India is the world's largest market for physical gold.

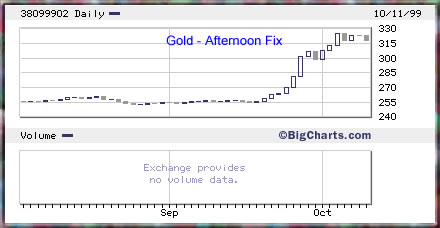

Central Banks are actively participating in the gold market, some as sellers and some as buyers. The European Central Banks have signed several agreements regarding gold selling. The first agreement was signed at September 1999 and ignited a strong rally(see chart below).

The UK signed the first Agreement but not the second (at the time the second Agreement was announced it stated that the UK government has no plans to sell gold).

I did not notice any press release regarding new UK gold sales so I can't agree with rumors. But they can certainly sell secretly (If they got any gold left)

OFFICIAL AGREEMENTS ON GOLD

Other Central Banks like Russia, China and UAE are buying or at least talking about buying gold.

Overall Gold continues to play an important monetary role and its importance is increasing along price - in my opinion. Yes, you are right, currently there is no sign of officially going back to the gold standard. However, one should not rule out a renewed gold standard or something similar.

Mr. Gary Dorsch published an interesting article which shows some interesting relations between global assets prices and gold. I had also posted about this subject and you can freely browse this blog archive.

See also : The importance of the Dow Jones / Gold, Gold / Oil & Gold / Silver ratios

Latest gold market headlines:

China, Raise gold holdings

China should take advantage of any weakness in bullion prices to build up its official gold holdings as part of a strategy for diversifying its foreign exchange reserves, a senior government economist said Monday.

Tuesday, July 04, 2006

China should take advantage of any weakness in bullion prices to build up its official gold holdings as part of a strategy for diversifying its foreign exchange reserves, a senior government economist said Monday.

Xia Bin, head of the financial research institute of the Development Research Center, a think tank under the Cabinet, also proposed that Beijing allow the yuan to fluctuate within a wider range against the dollar.

"It is practical for China to increase its holdings of gold by choosing an appropriate time to buy, because compared with other big trading countries the percentage of gold in China's reserves is seriously low," Xia said in an article on his agency's Web site.

Xia also suggested China establish an international investment fund with the aim of increasing returns from its US$900 billion-plus (HK$7.02 trillion) stockpile of reserves.

Chinese individuals should be permitted to buy into the fund, which would allow them to hold foreign exchange indirectly, he wrote. -source

Bank of Portugal sells 15 tonnes of gold

07/04/06 11:12 am (GMT)

LISBON (AFX) - The Bank of Portugal said it has sold 15 tonnes of gold from its reserves in the last few months.

The bank said the sales were aimed at diversifying its external reserves, with the proceeds to be kept in a special reserve at the central bank.

Last December, the bank sold 10 tonnes of gold.

The sales were carried out as part of the European Central Bank's agreement on gold sales which limits annual gold sales to 500 tonnes up to 2009. -source

Technically the daily chart from two days ago shows a Three White Soldiers - Bullish reversal pattern (high reliability)

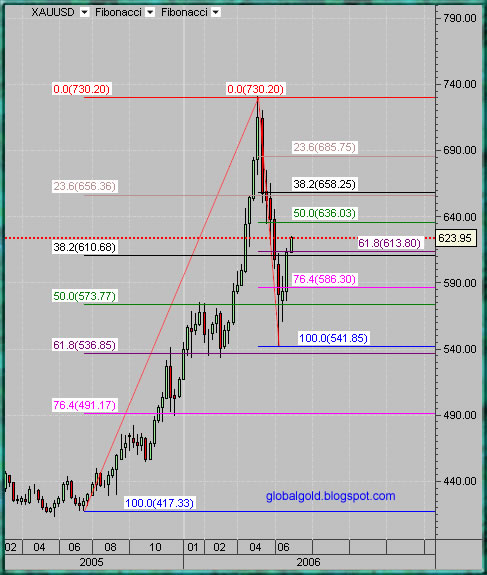

If you look at the weekly spot gold chart below what I see is a relatively good support between the 61.8% fibonnaci line on the short set and the 38.2% on the long set (610$ -613$). If that support doesn’t hold then gold will probably go down to the lower Fibonacci lines (573$ - 586$). Slight resistance around 636$ and more resistance at 656$ - 658$.

No comments:

Post a Comment