In the short term the technicals rule the price of gold. Gold was due for a bounce with or without the Bombay event (see yesterday chart).

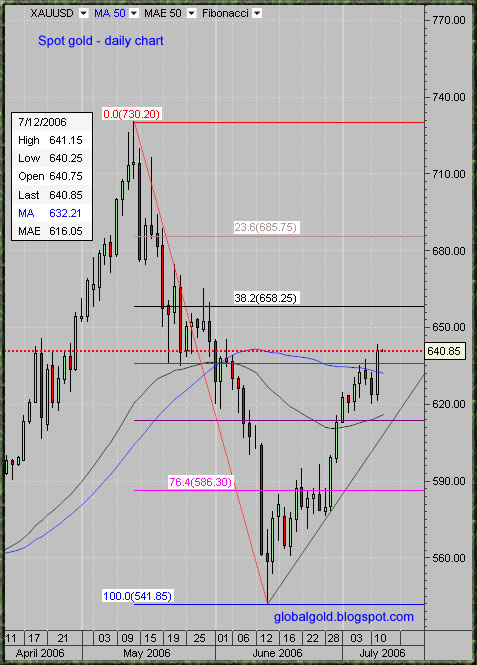

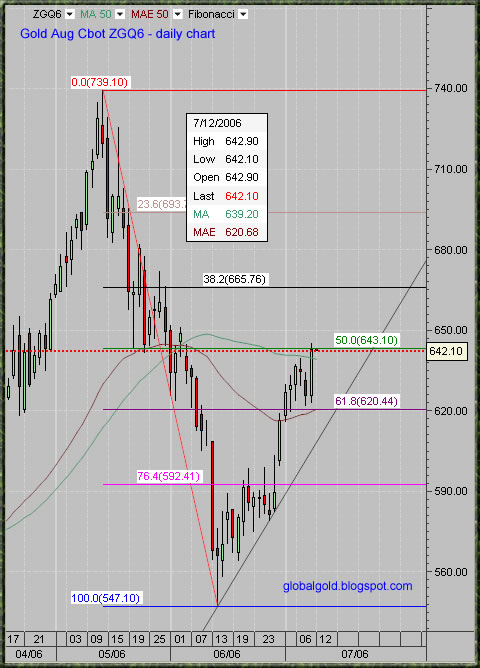

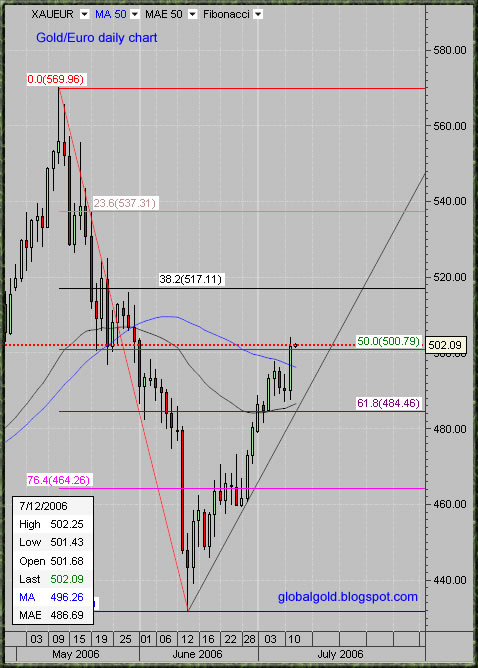

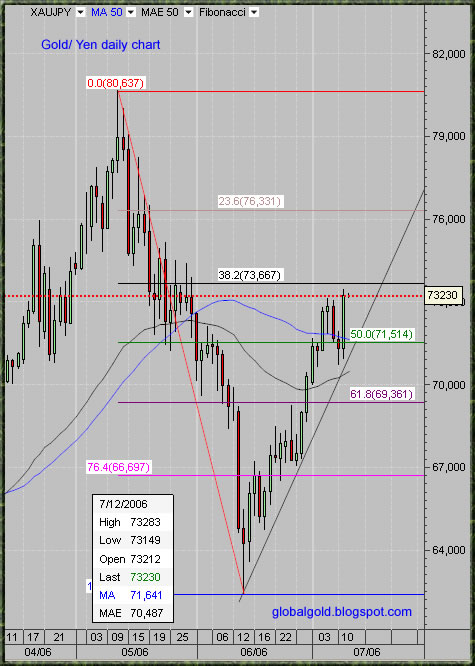

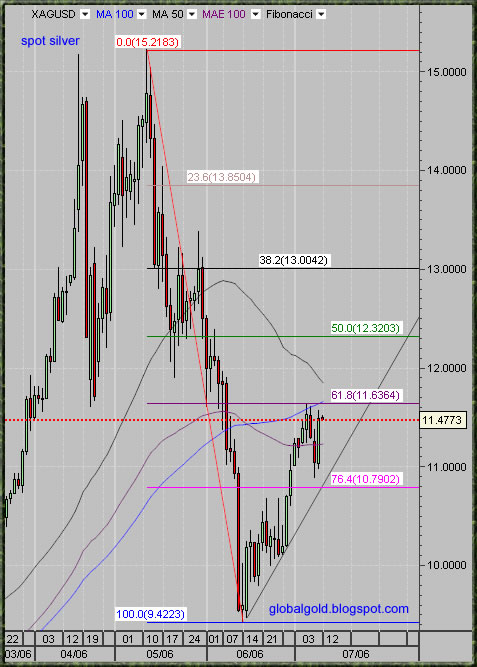

The Aug gold future contract managed to close above its 50 DMA but is currently still struggling with the 50% Fib line. Spot gold did cross its 50 DMA as well as the 50% Fib line. Gold/Euro is back above 500 Euro, above the 50 DMA and above the 50% Fib. Gold/YEN is looking the most bullish, well above the 50 DMA and just below the 38.2% Fib. Gold/Silver ratio = ~55.64, Gold/Oil ratio =~8.64, Dow/Gold ratio =~17.38. Silver continue to lag behind - still below the 61.8% Fib and the 100 DMA.

Fib lines above the current price are resistance and Fibs below are support, the same goes for moving averages(see charts below).

Zimbabwe: RBZ Eyes Gold Mine

THE Reserve Bank of Zimbabwe is reportedly eyeing a controlling stake in Globe and Phoenix Mine in a desperate bid to improve Zimbabwe's dwindling foreign currency reserves.

Sources told this paper that the Kwekwe-based gold mine was one of the projects that the Central Bank was eyeing with monetary authorities already having begun talks with unnamed horticultural producers for possible acquisitions. -source

By the way, anyone can copy my charts but please provide link and mention the source.

EWI are kind to offer free week(12 -19 July) of : Intraday Forecasts of US Stocks and EWI Financial Forecast Service- this service usually cost 6000$ a year , so this is a 115$ Free trail – check it out –( you only need to provide email and user name)

No comments:

Post a Comment