22 – 27 June 2008 August Gold (COMEX GCQ8 , CBOT ZGQ8 & YGQ8)

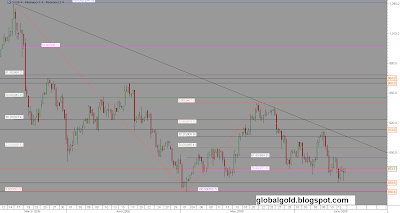

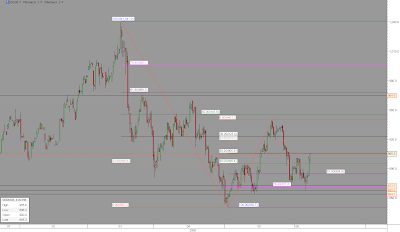

August gold future contracts ranged 56$ (~877$ - ~933$). Gold begun the week on the weak side (price did not make a lower low vs. previous week) but finished rather strong.

Support zones for GCQ8 : 875$ , 860$, 850$ and lower.

Resistance zones for GCQ8: 940$, 960$ - 964$ and 1041$.

August gold futures (GCQ8) 8 hours chart

Note: Gold / Crude oil ratio at historic lows