It's easy to be bearish on the stock market with the sharp sell off the last few days and interest rate at 5 years high. However I think that the NASDAQ is close to a short term important bottom and a rally to new highs might surprise. In my opinion gold will continue to outperform the NASDAQ (as well as the other indices) but higher gold price will also allow the stock market to go higher. To put it simple: The stock market will continue to go up (Bull market) but it will go down relative to the price of gold(Bear market), I also expect the NASDAQ or QQQQ volume to go down relative to GLD volume.

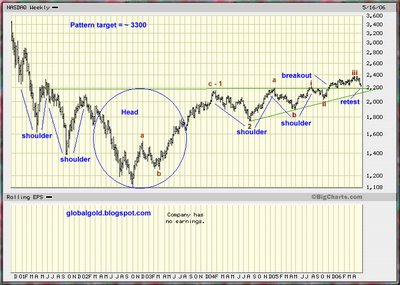

Here is a NASDAQ chart annotated with Elliott waves count (current wave iv of c of 3), I see a potential Inverted Head & shoulders formation and the target is ~3300. Click on the chart below to enlarge

1 comment:

A slight difference of opinion..

From the way I see it, it looks like the gold market is going into a sideways (i.e. corrective) pattern for now while the NASDAQ tanks. Also, the NDX 100 is much weaker than the NASDAQ itself.

The NDX 100 failed to make a new high when the DOW made a new high. This is a huge divergence in price and very bearish for stocks in general, IMHO. In a bear market, everything can get dragged down and this includes gold stocks as well.

So I am, short/intermediate term bearish and long term bullish for physical gold. Short and Long term bearish for the NASDAQ.

For additional technical data such as momentum, advance/declines, New Highs/New Lows, etc.

www.decisionpoint.com

can't be beat.

Post a Comment