Intresting Perspective / Case study :

Mon, Apr 24, 2006

source:

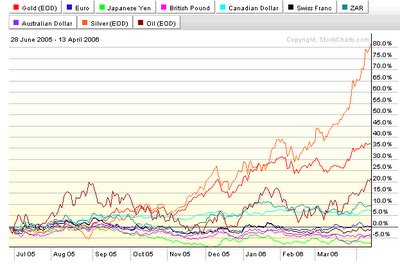

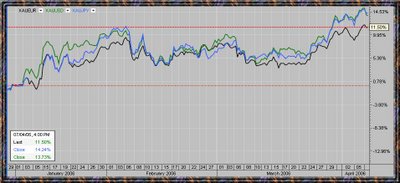

http://iran-daily.com/1385/2544/html/focus.htmGold PricesThe latest open market (unofficial) rates for major foreign currencies and prices of gold have shown huge increases since the beginning of the new Iranian year (started March 20, 2006).

For instance, the price of the full Bahar-e Azadi (old) gold coin reached 1,830,000 rials, followed by full Bahar-e Azadi (new) at 1,680,000 rials; half Bahar-e Azadi, 810,000 rials; and quarter Bahar-e Azadi 405,000 rials. In addition, gold prices also saw a significant growth, with 0.750 or 18 ct Methqal at 638,250 rials, and 0.750 or 18 ct Gram at 138,500 rials.

According to Donyaye Eqtesad, the above-mentioned figures suggest the old full Bahar-e Azadi gold coin saw some 16 percent increase within a few days in the last week of the current year. In fact, the world prices of gold saw just 1.5 percent increase whereas it was 16 percent for the full Bahar-e Azadi gold coin in Iran. Similarly, the price of gold coin in Iran was just 149,000 rials at the end of last year, but reached 195,000 rials at the beginning of this year, which means that it went up by 31 percent!

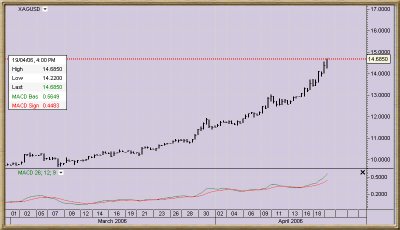

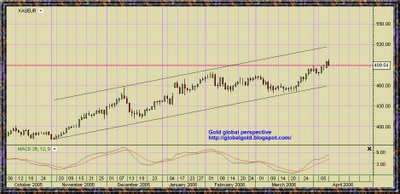

This is amid the fact that the price of one ounce gold was just $554 at the end of last year. It further reveals that the price of one ounce gold also underwent a 10-percent increase.

The huge difference between the prices of gold in Iran and those in the international markets show that although world prices of gold have gone up, they have no bearing on the significant increase in the price of gold in Iran, which has gone up for other reasons in the domestic market.

What can be the possible explanation for such a huge difference and who is behind it?

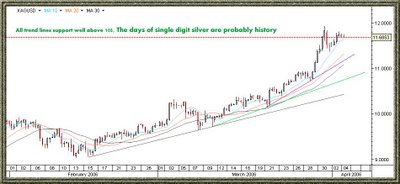

The first explanation for the sudden jump in gold prices in Iran could be that it follows the fluctuations of gold prices in world markets. The second cause, that is the pressure of demand, plays a far more significant role in creating such a huge difference. But what could have possibly caused such a demand in the Iranian markets?

The increase in the prices of crude oil in the international markets has led to a massive increase in government revenues and its current costs. This has, as a result, led to an increase in the volume of liquidity.

At a time when the housing market remains in recession and not much is going on in the stock market, the safest way to absorb the liquidity is the gold market. The initial increase in the prices of gold in the Iranian market - because of market fluctuations abroad - got the attention of market players. The initial growth encouraged them to buy more gold, and this, as a consequence, pushed up prices even further and far beyond those in the world markets.

The big question is whether such fluctuation in the gold market is in line with the government slogan of social justice for all?

No doubt, the current situation in the gold market does not bode well for the officials, but then again it is the direct result of their policies, which have increased current costs and contributed to liquidity growth.

Government officials should take note that they are not in a position to control all aspects of the market economy. They also need to ensure that their policies for a specific market will not cause trouble for other markets. "