So basically I think that under current conditions it's a waste of time to try and calculate a "fair" price for gold which is based on one set of data or another.

However, if one is interested in gold I wish to offer the following issues:

1) What is gold?

2) How to measure gold? (Purity and weight)

3) Ratios which allows a non currency dependent comparison between other assets and gold: Gold and Oil ratio I , Gold and Oil ratio II , Gold / Silver exchange rate, Dow / Gold ratio.

4) What are the drivers behind the price of gold?

During the last couple of years I have devoted considerable amount of time studying this issues and the relations between them, my conclusions are as follows:

1) Gold is often misunderstood, gold is a subject for love and hate, fear and greed, richness and poverty – gold is a subject for mixed and contradicting emotions. The amount of psychology involved with gold is endless.

2) The word speculations and speculators are often attached to gold. Gold is also "virtually" traded within the Forex and futures markets as such gold is often traded in an extremely leveraged and margined manner. However another perspective for speculation and gold which is rarely discussed is the fact that gold is heavily shorted by some market forces. There is a possibility that the total outstanding positions in gold are greater then all gold in existence. This is long term speculation from the sell side which might have sold more gold then they own or worse – they might have sold more gold then they can get. This possibility encapsulates a potential for the biggest short squeeze in history.

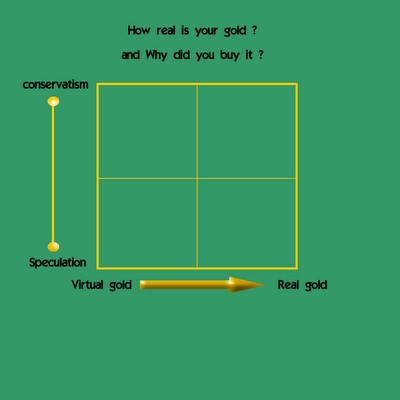

3) Gold is traded, bought and sold for many different reasons and different forms. The following diagrams illustrate:

That’s it for now.

No comments:

Post a Comment