The United States Mint is pleased to introduce its new line of 24-karat gold coins.

Production of these highly anticipated coins is authorized by Public Law 109-145, dated December 22, 2005, also known as the Presidential $1 Coin Act.

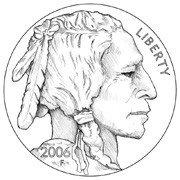

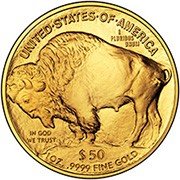

The new American Buffalo Gold coin’s obverse and reverse designs feature images originally prepared by noted American sculptor James Earle Fraser, once a student of Augustus Saint-Gaudens, for America’s 5-cent coin (nickel).

That popular coin, known as the Indian Head, or Buffalo, nickel was introduced in 1913 and showcases the native beauty of the American West.

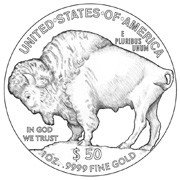

The Native American depiction on the coin’s obverse is believed to be based on three different Indian chiefs – two of whom were named by the designer as Chief Iron Tail and Chief Two Moons – who modeled for Fraser as he sculpted its design. Conflicting statements exist on the third Indian as being either Chief John Big Tree of the Onondaga tribe, or John Two Guns, son of White Calf. It is widely believed that the bison on the coin’s reverse was modeled after "Black Diamond," a popular attraction at the New York Zoological Gardens.

In the first year of the coin’s issuance, 1913, there were two distinct varieties, the first showing the bison on a mound and the second with the base redesigned to a thinner, straight line. American Buffalo Gold Coins bear the original Fraser Type I design.

United States Mint American Buffalo Gold Bullion Coins American Buffalo Gold Bullion Coins are the first .9999 fine 24-karat gold coins ever struck by the United States Mint and offered for sale through a network of Authorized Purchasers. These $50 gold coins will be available to members of the public seeking a simple and tangible means to own and invest in 24-karat gold in the form of legal tender coins whose content and purity is guaranteed by the United States Government.

American Buffalo Gold Bullion Coins will be available at many coin and precious metals dealers as well as many brokerage houses and participating banks. Pricing for precious metal investment coins typically depends on the market price of the metal. Click here to locate a dealer.

United States Mint American Buffalo Gold Proof Coins The United States Mint will produce a proof version of these coins for collectors. The term "proof" refers to a specialized minting process that begins by manually feeding burnished coin blanks into presses fitted with special dies. Each coin is struck multiple times so the softly frosted and highly detailed images seem to float above the field.

An official Certificate of Authenticity will accompany each coin. American Buffalo Gold Proof Coins will sell at a fixed price and can be purchased directly from the United States Mint.

Product Information All 24-karat American Buffalo Gold coins will be struck at the United States Mint at West Point . The 24-karat American Buffalo Gold Bullion Coins will be minted and sold in the same manner as American Eagle Bullion Coins . -

source