Dear readers,

Gold and silver caught some bids today and closed higher along a rising US dollar. Those of you who have been following my posts were certainly not surprised.

Some readers have emailed me with questions like: how do I make my gold price predictions (which are often very accurate) and what technical indicators I use for trading?

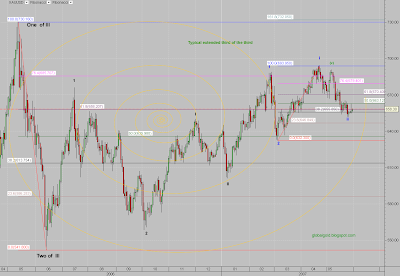

Well, I look at many different things: price & volume action, chart patterns, candle sticks, Fibonacci levels, moving averages, PPO, RSI, Stochastic, Inter market relationships, market sentiment and more. But above all cyclical analysis, namely Elliott wave analysis.

Elliott wave analysis is far from being a perfect tool (what is perfect?) However, as regards to making predictions Elliott waves counting when combined with other market indicators is the most valuable tool in my opinion.

Once you understand how the wave principal works, you will learn to respect the market opinion, you will stop looking for reasons to explain why the market is doing this or that. You will learn to accept the cyclical nature of waves.

One excellent book for learning wave analysis is:

Elliott wave principle by Frost & Prechter.

By the way, I'm currently reading Prechter's latest book:

How to Forecast Gold and Silver Using the Wave Principle. This 483 page book is an amazing documentary which aggregates all of the author gold and silver real time analysis between 1979 -2001.

I will post a more detailed review once I finish reading

this book. For now I would just say that while Prechter is usually known for his bearish predictions, I was very surprised to read about some extremely bullish price objective for gold that might still be valid today.

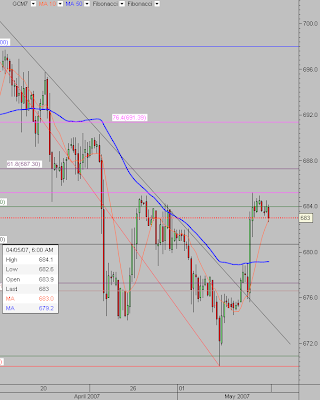

Short term technical update:The price of gold is still inside the downtrend channel.

ZGM7 – CBOT June Gold Intraday (120 minutes) chart