Virtual silver fund, bulls get a bit disappointed...

By Kevin Morrison

Published: March 6 2006 17:44 | Last updated: March 6 2006 17:44

A silver price tracker fund, also known as an exchange traded fund, is expected to be launched on the London Stock Exchange within the next month by ETF Securities, which has already launched an oil-backed ETF on the LSE.

The planned new investment product is separate to the silver-backed ETF filed by Barclays Global Investors with the Securities and Exchange Commission, which is expected to make a decision shortly on the proposal.

It is understood that ETF Securities has approval from the UK’s Financial Services Authority. ETF Securities is controlled by Graham Tuckwell, who listed the world’s first commodity-backed ETF when he launched Gold Bullion on the Australian Stock Exchange three years ago.

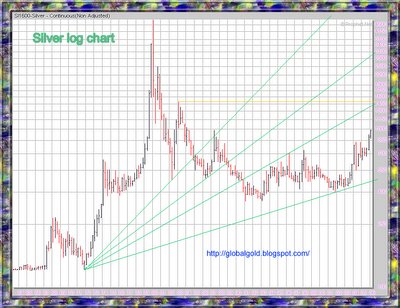

Silver prices closed at a 22-year high last week, and were trading at $10.25 a troy ounce in mid-afternoon trade in London, up 7 cents from Friday’s close.

Expectations of a launch of a new silver-ETF in the US have been a key driver behind the recent surge in the silver price, which has risen 60 per cent since the start of 2005. Once fully issued, the proposed BGI silver ETF would require the purchase of 130m ounces of silver, according to the fund’s prospectus.

However, few have factored in the possible listing of a silver investment product in London.

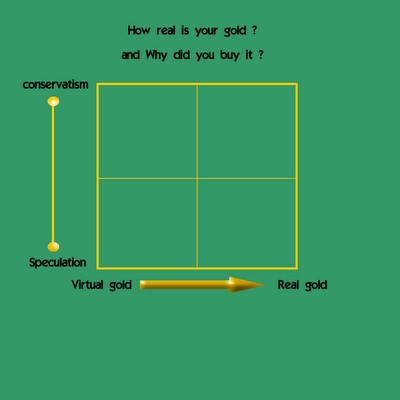

Unlike the various gold and oil backed ETFs and the BGI initiative, the proposed silver fund in London will not be physically backed by the underlying commodity.

The funds raised by the proposed London listed silver ETF would not be spent on buying the metal, but the performance of the fund would remain linked to the silver price. Funds raised by existing commodity-backed ETFs are spent on buying the physical commodity, which adds to the increase in demand.

Advisers to ETF Securities have warned that demand for a silver ETF could distort prices and affect demand as the silver market was too small to support large amounts of the metal allocated to investors. This is an argument used by the Silver Users Association in its opposition to the proposed US silver ETF.

“We do not have to look back very far to see the impact a significant amount of allocated silver would have on the market. It was 1998 when Warren Buffet purchased over 100m ounces of physical silver and the spot price rallied over $3,” it said.

source