Gold is neither holy nor sacred; I do not worship gold or anything else for that matter.

The purpose of this site is to share my thoughts and knowledge.

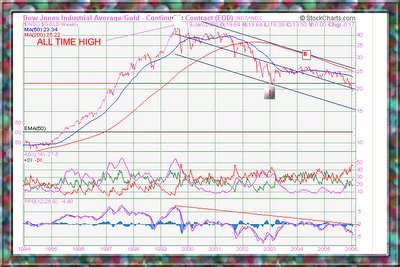

Many analysts tend to explain the movements in the price of gold with political events, I disagree about that. In my opinion the price of gold doesn't have much to do with politics like most analysts tend to think.

What are the drivers behind the price of gold?

The variables which determine the price of gold could be devised into two main groups:

Internal variables:

1) Physical gold supply(limited) and demand.

2) Paper gold (futures, options, OTC derivatives, CFD, ETF, etc.) supply (unlimited) and demand.

3) Crowd psychology regarding gold – is gold cheap or expensive?, should I buy, sell or hold?, why is the price going up or down? , fear and greed. Etc.

External factors:

1) Monies supply in the form of M1, M2, M3…Mn , for each currency C1, C2, C3…Ck, Subtotal of the summarize matrix {[Mn] X [Ck]}

2) Systematic risks and malfunctions of the global monetary system and the crowd psychology regarding those issues.

3) Inflations deflations debates, expectations and perceptions.

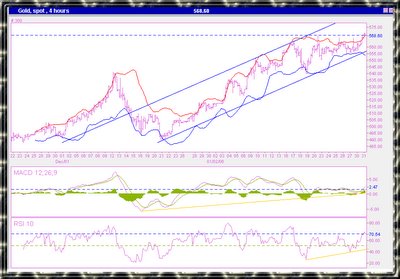

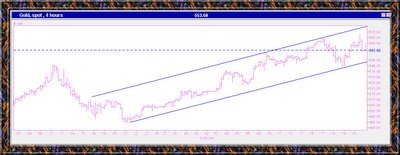

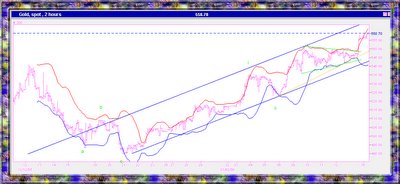

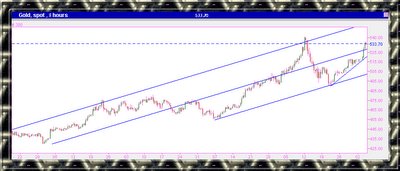

All of those are very complicated issues which are largely misunderstood even by the professional gold analysts. That’s my opinion and this is why technical analysis is so important when you want to understand the gold market.

More later real1.