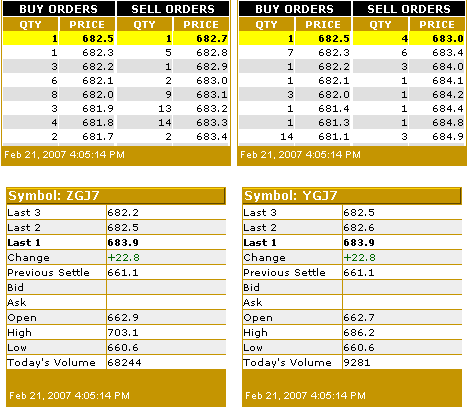

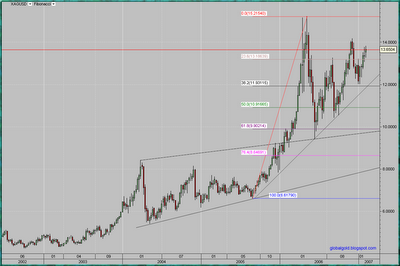

Lets go straight to the point, given the extreme volatility, gold defined a trading range of 33$, 655$ - 688$ for the spot price. In my opinion gold can stay inside this trading range for some time as new positions are building up. A break below the trading range will send the price of gold towards 600$ while a break above and the 2006 high (730$) comes to play. Which way will it go? Well, can go both ways and ultimately depends on where the stop limit orders will be positioned. Continue to be cautious, Play the game or be played!