Gold and Silver Mining Stocks

Commodities Charts

Elliott Wave Tutorial

Here are some charts of Gold in Euro, Yen, US Dollar Index & Silver.

Gold, Silver & Forex Charts, Technical Analysis , News, Reports & Commentary.

It's easy to be bearish on the stock market with the sharp sell off the last few days and interest rate at 5 years high. However I think that the NASDAQ is close to a short term important bottom and a rally to new highs might surprise. In my opinion gold will continue to outperform the NASDAQ (as well as the other indices) but higher gold price will also allow the stock market to go higher. To put it simple: The stock market will continue to go up (Bull market) but it will go down relative to the price of gold(Bear market), I also expect the NASDAQ or QQQQ volume to go down relative to GLD volume.

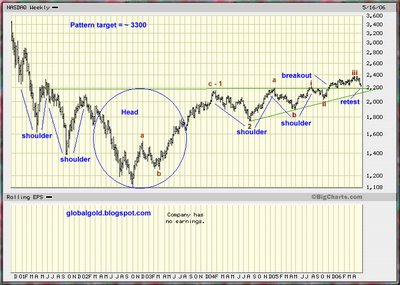

Here is a NASDAQ chart annotated with Elliott waves count (current wave iv of c of 3), I see a potential Inverted Head & shoulders formation and the target is ~3300. Click on the chart below to enlarge

The gold price hit a bottom at ~674$ then rallied ~30$ , here is an Intraday spot gold chart with Fibonacci support lines , moving averages and trend line , there are numerous other technical indicators but I find this most useful. – this blog is focused mainly on the price of spot gold and silver , my other blogs are focused on commodities in general and gold , silver , metals mining stocks, If you are looking for an excellent capital markets & social equity blog I highly recommend Bill Cara.

Click on the chart below to enlarge:

The Gold Silver ratio (XAU / XAG) = ~49.85, Dow / Gold = ~15.94, Gold / Oil (Light Sweet Crude) = ~9.92. Here are Spot Gold (XAU) and Spot Silver (XAG) intraday charts annotated with moving averages, trend lines and Bollinger bands.

Beijing whispers push gold to $700By Ambrose Evans-Pritchard (Filed: 10/05/2006)

Gold has surged to $700 an ounce for the first time in 26 years after Chinese economists suggested the country should quadruple its bullion reserves to protect against a falling dollar.

Speculators have been alert to any sign that Beijing may be planning to switch a portion of its massive $875bn reserves into gold, a move that would electrify the market.

They seized on comments yesterday by Liu Shanen, an official at the Beijing Gold Economy Development Research Centre, who said China should raise the portion of gold in its reserves from 1.3pc today to between 3pc and 5pc. Such a move would entail the purchase of 1,900 tonnes of gold, equivalent to gobbling up nine months of global mine production.

Washington's cold response to Iran's move to defuse nuclear tension also helped fuel yesterday's rally. "No one is buying Iran's overtures," said Frank McGhee, a metals trader at Integrated Brokerage Services. "This is a purely geo-political move for gold. We've been here before. The difference is that this time, there are nukes involved."

June gold futures jumped $20.10 an ounce in New York, briefly touching the $700 line before falling back slightly.

Tan Yaling, an economist at the Bank of China, backed the call for higher gold reserves to "help the government prevent risks and handle emergencies in case of future possible turbulence in the international political and economic situation".

John Reade, a UBS analyst, said neither economist had any official role but hints were enough to drive prices in the current climate. "This is an investor frenzy, and China has become the biggest rumour in the gold world right now," he said.

Mr Reade said gold had changed stride since the middle of last year, the key moment when it broke out against all major currencies and began to attract investment from the big money brigade.

"Speculative and investment interest has replaced jewellery demand. The last time that happened was in 1979 to 1980," he said.

He said it was likely that Middle Eastern investors were switching petrodollars into gold after burning their fingers in local stock markets.

Ross Norman, director of the BullionDesk.com, said China may already be a silent buyer on the open market.

Central banks are supposed to record their gold purchases with the IMF promptly, but they have been known to move stealthily for months before declaring.

"This market has been bouncing back so quickly after each bout of profit-taking that it looks as if somebody big is trying to get in. It's too darn hot for my liking," he said.

Mr Norman said there was a fair chance that gold mining equities would start to play "catch-up". -source